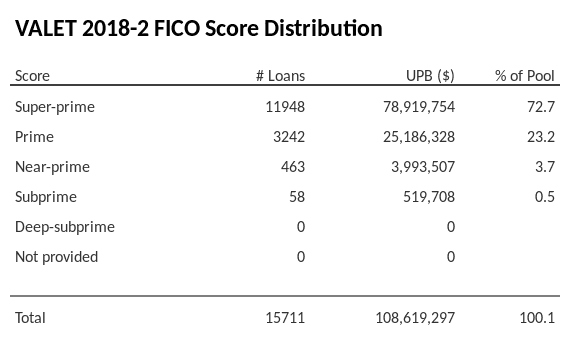

FICO Distribution - VALET 2018-2

VALET 2018-2 has 72.7% of its pool with Super-prime FICO scores.

Chart Summary

VALET 2018-2 has 72.7% of its pool comprised of loans with Super-prime FICO scores, totaling $78,919,827 in unpaid principle balance according to Edgar sec.gov filings. The reporting period for this information begins 2022-04-01 and ends 2022-04-29.

Prompts

Explore a variety of thoughtfully crafted prompts below, each tailored for specific use cases. Each card includes a convenient copy-paste button that lets you seamlessly transfer the prompt into your favorite AI tool. Whether you're using ChatGPT, Google Bard, or Claude, these prompts are designed to help you unlock new insights and ideas. Simply click 'Copy' to get started!

Summarize FICO Score Distribution

Summarize the fico distribution for VALET 2018-2. Break down the number of loans, UPB, and percentage of the pool for each FICO category (e.g., Super-prime, Prime, Subprime). Highlight the dominant FICO segment and what this indicates about the credit quality of the pool.

Highlight Credit Quality Concentration

Analyze the fico distribution for VALET 2018-2 to identify any concentration in specific FICO categories. Discuss the implications of having a high percentage of the pool in Super-prime or Prime categories versus Subprime or Deep-subprime.

Compare to Historical FICO Trends

Compare the fico distribution for VALET 2018-2 to historical FICO score distributions for ABS auto deals issued since 2017. Highlight any deviations, such as a larger-than-average allocation to Subprime, and discuss what this indicates about underwriting or market conditions.

Visualize Credit Tier Distribution (Bar Chart)

Create a bar chart visualization based on the fico distribution for VALET 2018-2, showing the UPB for each FICO category. Highlight the largest FICO category with a distinct color and annotate the chart with its percentage of the pool.

Risk Assessment for Subprime Allocations

Using the fico distribution for VALET 2018-2, assess the risk associated with loans in Subprime and Deep-subprime categories. Discuss how these allocations could impact delinquency and default rates in various economic scenarios.

Impact of Missing FICO Data

Evaluate the potential risks associated with the "Not provided" FICO category in the fico distribution for VALET 2018-2. Discuss whether missing FICO data might obscure risks or indicate specific underwriting practices.

Compare Credit Quality Across Peer Deals

Benchmark the fico distribution for VALET 2018-2 against other ABS auto loan or lease deals issued in the same year. Discuss how the FICO distribution aligns with or deviates from peer deals and what this suggests about borrower quality.

Visualize Hypothetical Performance Scenarios

Using the fico distribution for VALET 2018-2, simulate a hypothetical economic downturn where default rates for Subprime and Deep-subprime loans increase by 10%. Visualize the impact on overall pool performance and discuss potential investor concerns.

Assess Diversification Across FICO Categories

Evaluate the diversification of VALET 2018-2's fico distribution by analyzing the spread of loans across FICO categories. Discuss whether this diversification helps mitigate risks or if over-concentration in specific categories poses challenges.

Find Additional Credit Data

Identify sources where you can access more data on the FICO distribution for VALET 2018-2. Include platforms like trustee reports, rating agency updates, or issuer disclosures for detailed insights into the credit quality of the pool.

Compare Prime and Non-Prime Allocations

Analyze the split between Prime (e.g., Super-prime, Prime) and Non-prime (e.g., Subprime, Deep-subprime) allocations in VALET 2018-2's fico distribution. Discuss how this mix influences the pool's overall risk profile and investor appeal.

Create a Weighted Average FICO Metric

Calculate the weighted average FICO score for VALET 2018-2 using the fico distribution. Include the calculation methodology and discuss how this metric can help investors assess the credit quality of the pool.

Analyze Trends in Credit Tier Shifts

Compare the fico distribution for VALET 2018-2 to FICO score distributions from prior deals by the same issuer. Highlight any trends, such as shifts toward higher or lower credit tiers, and discuss their potential implications for underwriting strategy.

Assess Sensitivity to Macroeconomic Conditions

Discuss how VALET 2018-2's fico distribution might perform under macroeconomic conditions such as rising unemployment or declining used car values. Focus on how loans in Subprime and Deep-subprime categories might be affected.

Other Links

Get the data

Dataset used to create this chart

Exact curated dataset used to create this chart and other charts on this site.