BlackRock CRE Analysis

Tracing BlackRock Commercial Real Estate: A Data Lineage Approach

Headlines about BlackRock commercial real estate often focus on its massive scale but miss the underlying data story relevant to structured-finance analysts. To truly understand its market impact, one must move beyond high-level AUM figures and trace the connections between its equity holdings in REITs and the underlying debt in CMBS deals. This requires a programmatic approach grounded in verifiable data lineage—connecting public filings to asset-level performance. This guide breaks down the technical workflow for deconstructing BlackRock's CRE exposure, demonstrating how to link SEC filings to securitized loan data. By visualizing this data lineage, analysts can build more precise risk models and gain deeper market intelligence, a process simplified by platforms like Dealcharts.

Market Context: BlackRock's Strategic Footprint in CRE

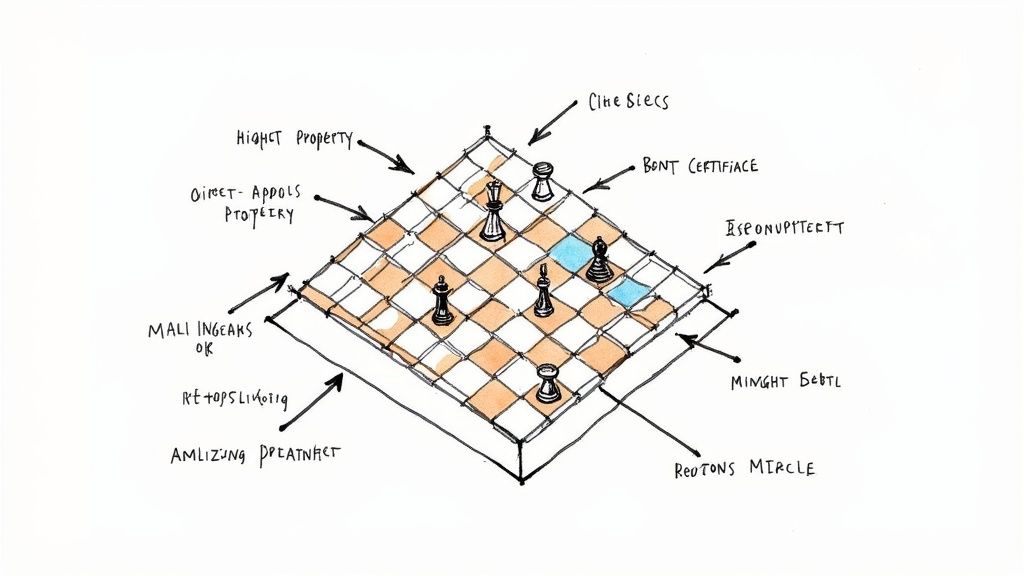

BlackRock’s influence in commercial real estate isn't just about size; it's about a multi-channel strategy executed with data-driven precision. The firm operates across direct property investments, publicly traded Real Estate Investment Trusts (REITs), and real estate debt, including significant involvement in Commercial Mortgage-Backed Securities (CMBS). This blended approach allows it to allocate capital dynamically across the capital stack, from equity to senior debt, based on market cycles and risk appetite.

Current market trends, such as the bifurcation between struggling office assets and resilient industrial or data center properties, highlight the importance of this strategic flexibility. For analysts, the key technical challenge is piercing the corporate veil to connect these distinct but related exposures. A significant holding in a public REIT, visible in a 13F filing, might have direct implications for the performance of a CMBS deal collateralized by that same REIT's properties. Understanding this interconnectedness is critical for accurate risk modeling, especially as credit conditions tighten and property-level performance comes under scrutiny. Tracing the firm's footprint requires navigating a complex web of public filings and private deal documents, a task central to modern credit surveillance. You can get more context on BlackRock's market scale and history to appreciate the sheer depth of their experience.

The Data Trail: From 13F Filings to CMBS Loan Tapes

For any serious quant or analyst, data lineage is non-negotiable. A number without a verifiable source is an opinion, not a fact. This section maps out the data sources required to trace BlackRock commercial real estate positions from high-level regulatory filings down to the granular loan level within CMBS deals. The objective is to build a verifiable, bottom-up view of exposure.

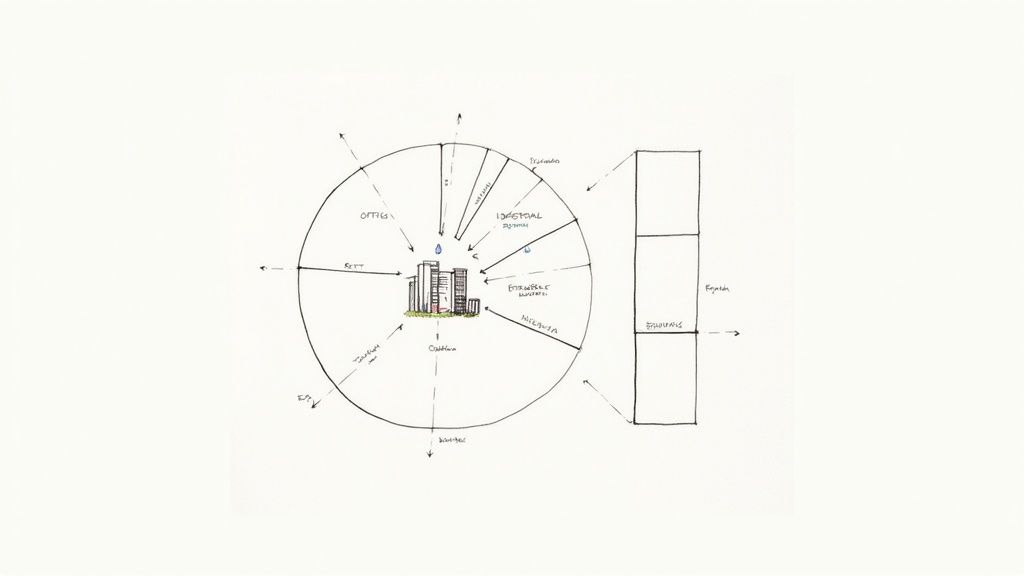

The primary data sources include:

- SEC 13F-HR Filings: These quarterly reports are the starting point, disclosing BlackRock's long positions in publicly traded securities. By parsing these filings from the SEC's EDGAR database, an analyst can identify and track stakes in major CRE-focused REITs. This data reveals sector bets and shifts in allocation over time.

- 424B5 Prospectuses: For any new CMBS deal, the prospectus is the foundational document. It details the underlying loan pool, property information, key tenants, and the security's payment waterfall. Analysts parse these documents to identify loans backed by properties owned by the REITs identified in 13F filings.

- 10-D Remittance Reports: Filed monthly or quarterly, these reports provide ongoing surveillance data on a CMBS deal's performance. They contain critical information on loan delinquencies, prepayments, servicer comments, and updated property financials, offering a real-time view of asset health.

The core technical challenge lies in linking these disparate datasets. An analyst must connect a CUSIP from a 13F filing (identifying a REIT) to a property address in a 10-D remittance report, which in turn is part of a CMBS deal identified by its own CUSIP. This requires robust data parsing, entity resolution, and a structured data environment. The Dealcharts platform, for instance, provides pre-linked datasets that connect these filings, deals, and counterparties, accelerating this analytical workflow. A guide on interpreting sold prices, like this one explaining UK Commercial Real Estate Sold Prices Explained, can be invaluable for valuing the underlying assets.

Workflow Example: Programmatically Tracking REIT Holdings

Theory is useful, but reproducible code provides verifiable proof. This section provides a practical workflow for tracking a slice of the BlackRock commercial real estate portfolio, with a focus on transparent data lineage. We will programmatically extract 13F-HR filing data directly from the SEC's EDGAR system to identify holdings in specific CRE-focused REITs. This process demonstrates explainability in action: every step, from the raw government filing to a structured DataFrame, is explicit and auditable.

Step 1: Source and Parse SEC Filings

Ground-truth analysis begins at the source. For institutional holdings, the quarterly 13F-HR filing is that source. These documents are filed in a structured XML format, making them ideal for programmatic parsing. The workflow involves fetching BlackRock's filings using its Central Index Key (CIK) from EDGAR, then extracting the holdings table. Each entry contains the issuer's name, CUSIP, share count, and market value.

This data lineage is clear: Raw SEC filing → XML parsing → Structured holding data.

Step 2: Example Python Snippet for 13F Data

The following Python snippet demonstrates this process. It uses the

library to fetch a specific 13F-HR filing for BlackRock from EDGAR andrequests

to parse it into a pandas DataFrame. This provides the foundational dataset for further analysis.xml.etree

import requestsimport pandas as pdfrom xml.etree import ElementTree as ET# Define BlackRock's CIK and the target filing's accession numberCIK = "0001364742"ACCESSION_NUMBER = "0000950123-23-009311" # Example filing for Q3 2023# Construct the URL for the primary XML document of the filingurl = f"https://www.sec.gov/Archives/edgar/data/{CIK}/{ACCESSION_NUMBER.replace('-', '')}/{ACCESSION_NUMBER}-primary-doc.xml"# Set a user-agent header as required by SEC EDGARheaders = {'User-Agent': 'YourName/1.0 your.email@example.com'}response = requests.get(url, headers=headers)response.raise_for_status() # Ensure the request was successful# Define the XML namespace to properly find elementsnamespace = {'ns': 'http://www.sec.gov/edgar/thirteenf/informationtable'}holdings_list = []# Iterate through each 'infoTable' element in the XML rootfor info_table in root.findall('ns:infoTable', namespace):holding = {'nameOfIssuer': info_table.find('ns:nameOfIssuer', namespace).text,'cusip': info_table.find('ns:cusip', namespace).text,'value': int(info_table.find('ns:value', namespace).text) * 1000, # Value is in thousands'shares': int(info_table.find('ns:shrsOrPrnAmt/ns:sshPrnamt', namespace).text)}holdings_list.append(holding)# Convert the list of holdings to a pandas DataFrame for analysisdf_holdings = pd.DataFrame(holdings_list)# Filter for specific REITs to demonstrate insight extractioncre_reits_of_interest = ["PROLOGIS INC", "SIMON PROPERTY GROUP INC", "AMERICAN TOWER CORP"]print("BlackRock Holdings in Key REITs (Q3 2023):")print(df_holdings[df_holdings['nameOfIssuer'].isin(cre_reits_of_interest)])

The output of this script is a structured table linking issuer name, CUSIP, and position size. This structured data is the first link in the chain. From here, an analyst can cross-reference these REIT holdings with CMBS loan tapes from deals like the COMM 2019-GC44 transaction or the SG Commercial Mortgage Securities Trust 2016-C5 to map equity ownership to specific securitized assets.

Implications for Risk Modeling and Context Engines

This structured, verifiable data lineage fundamentally changes how risk is modeled. Instead of relying on broad sector assumptions, analysts can build "model-in-context" frameworks that account for the interconnectedness of equity and debt markets. This approach moves beyond static, black-box models toward explainable pipelines where risk factors can be traced back to their source.

For example, a credit model can now incorporate second-order risks. A significant reduction in BlackRock's holding of a specific office REIT (spotted via the 13F workflow) can serve as a leading indicator of potential stress for CMBS deals with high exposure to that REIT's properties. This allows risk models to become more dynamic and predictive, pricing in information that would otherwise remain siloed. This is central to the CMD+RVL philosophy of building context engines for finance: transforming raw data into structured, interconnected knowledge that improves machine reasoning and human analysis. Techniques from AI in financial risk assessment provide a roadmap for integrating these complex, interconnected signals into more sophisticated predictive models.

How Dealcharts Accelerates This Analysis

The primary bottleneck in this entire process is data engineering—sourcing, parsing, cleaning, and linking disparate datasets from SEC filings, servicers, and trustees. This foundational work is time-consuming and distracts from high-value analysis. This is the problem Dealcharts is built to solve. It provides a pre-linked, structured data environment where the connections between entities are already mapped.

Dealcharts connects these datasets—filings, deals, shelves, tranches, and counterparties—so analysts can publish and share verified charts without rebuilding data pipelines. Instead of spending days writing parsers, you can immediately query the relationships between BlackRock's REIT holdings and the performance of underlying loans in specific 2023 CMBS vintage analytics. This collapses the time from question to verifiable insight, enabling analysts to focus on risk modeling and strategy rather than data plumbing.

Conclusion

Analyzing a portfolio as vast as BlackRock's demands a programmatic, data-first approach grounded in verifiable lineage. By tracing holdings from high-level 13F filings down to granular loan-level data within CMBS deals, analysts can move beyond opaque AUM figures to build transparent, context-aware risk models. This explainable pipeline is no longer a niche capability but a requirement for robust financial analysis. Frameworks like CMD+RVL and platforms like Dealcharts provide the tools to build these reproducible, explainable insights at scale.

Article created using Outrank