Model Context Protocol MCP

Model Context Protocol (MCP) for enterprise AI in Structured Finance Workflows

Intro

The Model Context Protocol (MCP) for enterprise AI unlocks secure, auditable, and scalable integrations across structured-finance pipelines—enabling analysts, data engineers, and quants to link live remittance tapes, prospectus data, and performance feeds directly into LLM-driven workflows. In a space where Q3 2025 ABS delinquency rates reached 2.7% and investor‐reporting demands grow ever more stringent, MCP offers a standardized interface for discovery, invocation, and metadata lineage. By treating tools, data resources, and prompts as first-class entities, MCP ensures every query is traceable back to its source (EDGAR filings, loan-level tapes, or proprietary Dealcharts datasets). This guide demonstrates how MCP drives context-aware, reproducible analytics—complete with code snippets, JSON schemas, and real‐world lineage pointers.

Section 1: Market / Context Overview

Structured-finance teams juggle multiple data silos—loan-level tapes, trustee remittance files, trustee certificates, and EDGAR 10-D filings—while meeting investor‐reporting SLAs and regulatory audits. Without a unified protocol, custom connectors proliferate, workflows grow brittle, and provenance vanishes. In 2024–25, regulatory bodies have tightened transparency rules for CMBS and ABS transactions, demanding real‐time monitoring of credit performance and automated alerts on covenant breaches.

MCP addresses these challenges by:

- Standardizing AI integrations across platforms (Snowflake, Salesforce, S3, on-prem data lakes).

- Embedding row-level permissions and token scopes to enforce least-privilege access.

- Streaming live remittance updates and dynamic prompt templates into LLM agents.

- Capturing full context graphs to satisfy audit and compliance requirements.

As ABS and CMBS structures become more complex—layered tranches, waterfall triggers, step-ups—analysts need tools that dynamically adapt to new filings and data sources. MCP’s discovery interface, metadata models, and registry-driven endpoints offer a single “USB-C” port for all enterprise AI workflows, slashing integration times from weeks to hours.

Section 2: Data / Technical Angle

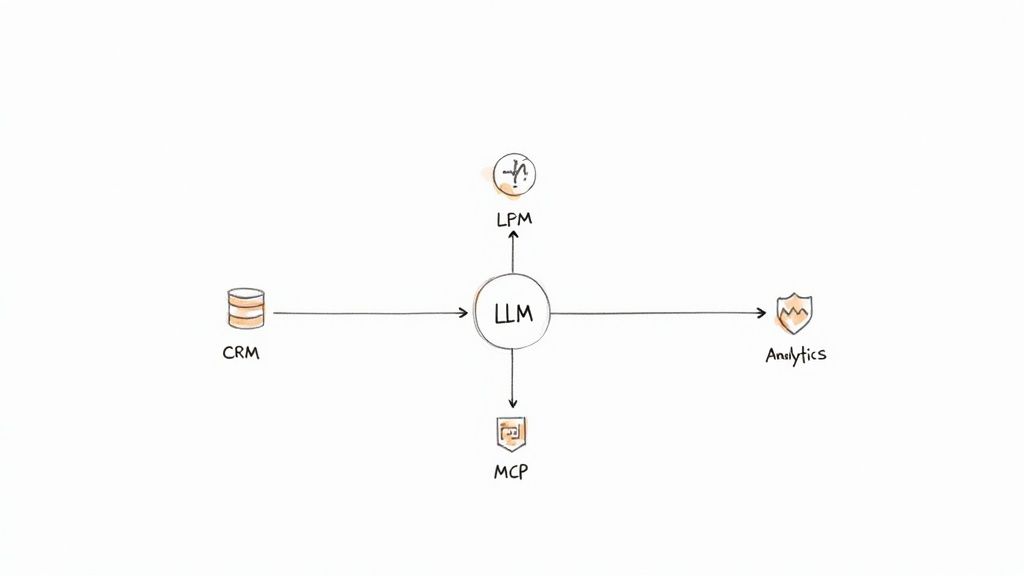

At its core, MCP revolves around three primitives—Tools, Resources, and Prompts—underpinned by a central registry, client SDKs, and a governed server layer. Here’s how structured-finance data flows through MCP:

Tools, Resources, and Prompts

- Tools: Defined functions (e.g.,

,queryTable

,runPrompt

) that let LLM agents perform tasks such as fetching tranche balances or generating visualizations.generate_chart - Resources: Live feeds—loan‐level tapes, 424B5 prospectuses, trustee remittance data—served at runtime with metadata pointers for lineage.

- Prompts: Parameterized templates guiding model interactions (e.g., SQL queries, narrative summaries) with fallback controls.

Server Registry and Client SDKs

- Server Registry: Publishes endpoint URIs, JSON schemas for resources, token‐scope definitions, and versioned TTL settings.

- Client SDKs (Java, Python, TypeScript): Handle authentication handshakes, JSON (de)serialization, token refresh, and high‐level calls (

,discoveryRequest

).toolInvoke

Data Schema and Lineage

Every resource carries a

back to its origin—Dealcharts context graphs or official filings. Example JSON schema for a “transactions” table:lineagePointer

{"resourceType": "table","name": "transactions","columns": [{"name": "cusip", "type": "string"},{"name": "amount", "type": "decimal"}],"permissions": ["read"],"lineagePointer": "link://dealcharts/transactions"}

This schema ensures row-level security (

only) and full auditability via the embedded pointer.read

Integration Patterns and Security Guardrails

- Connector-Based Access: Direct links to platforms like Snowflake or Salesforce with token scopes for row‐level security.

- API Gateway Plugins: Centralize policy enforcement, translating MCP requests to REST/gRPC calls.

- Push vs. Pull: Webhook/event‐driven updates for live monitoring or on-demand fetches for ad-hoc analytics.

Layer in TLS 1.2+, AES-256 encryption at rest, token rotation (every 30 days), and vulnerability scans to meet enterprise compliance. Audit logs capture every discovery and toolInvoke call—complete with context tokens and session graphs.

Performance and Observability

Monitor MCP traffic by tracking:

- Discovery Latency (P95)

- Request Throughput (calls/sec)

- Error Rate (%)

- Audit Trail Completeness

Use Prometheus + Grafana (or Datadog) and load-test with Locust to validate scale targets. Aim for sub-50 ms discovery calls and sub-200 ms LLM prompt round-trip times.

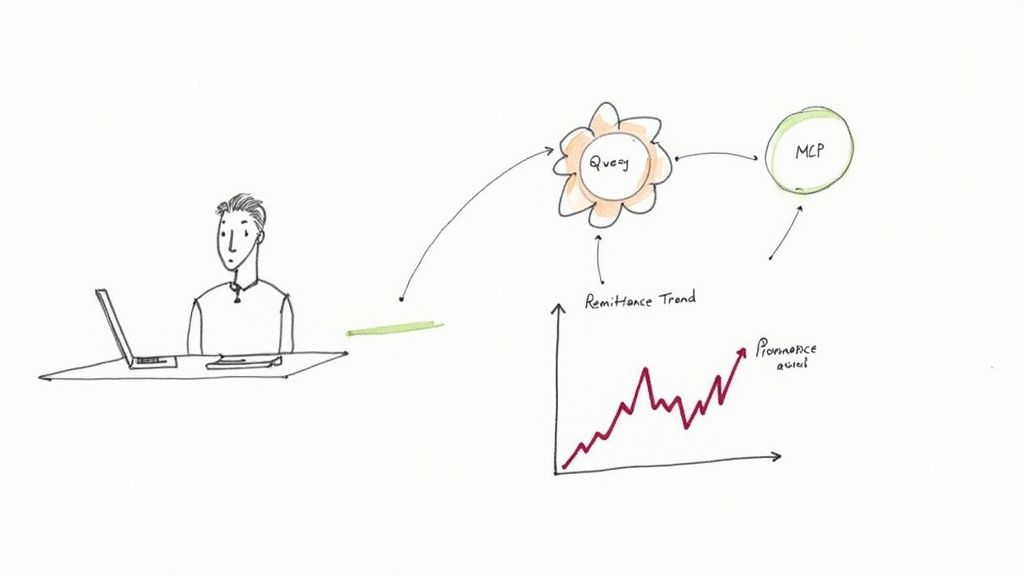

Section 3: Example or Workflow

Below is a step-by-step workflow for querying ABS tranche balances via MCP, complete with JSON, Python, and an embedded demo.

1. Discovery Request (JSON)

{"type": "discoveryRequest","clientId": "abs-analyst-01","metadata": {"capabilities": ["queryTable"],"context": {"assetClass": "ABS", "tranche": "A2"}}}

2. Python Snippet: Tool Invocation

from mcp_client import MCPClientclient = MCPClient(registry_url="https://registry.local", token="ABC123")# Discover the transactions tooltools = client.discovery_request(capabilities=["queryTable"])txn_tool = next(t for t in tools if t.name == "transactions_query")# Invoke with parametersresponse = client.tool_invoke(tool_id=txn_tool.id,payload={"trancheId": "A2", "date": "2025-09-30"})print(response.data) # JSON rows + lineage metadata

3. Context Token Graph

Each call returns a context token that binds:

- Identity: User or service ID

- Session Graph: Nodes (resources, prompts), edges (call sequence)

- Window Rules: Token expiry and refresh thresholds

This token ensures your LLM prompt never exceeds token limits and always includes the right metadata slice.

Section 4: Insights or Implications

Embedding Model Context Protocol (MCP) into structured-finance analytics yields profound benefits:

- Explainable Pipelines: Context metadata and session graphs make every AI step auditable end-to-end.

- Model-in-Context: Fresh remittance feeds and prospectus clauses flow directly to LLM agents, enhancing reasoning and reducing hallucinations.

- Risk Monitoring: Real-time tranche performance and delinquency thresholds can trigger automated alerts, with provenance for compliance.

- Scalable Governance: Token scopes enforce row-level security, while API gateways centralize policy across CMBS, ABS, and credit portfolios.

- CMD+RVL Context Engines: MCP serves as the “context engine” in the CMD+RVL framework—linking data plumbing (ODPS, EDGAR, Dealcharts) to model scoring layers.

By treating each tool, resource, and prompt as graph nodes, MCP transforms AI workflows into dynamic, explainable engines—delivering reproducible analytics on demand.

Section 5: How Dealcharts Helps

Dealcharts integrates MCP to connect filings, deal structures, tranches, and remittance tapes into a unified context graph. Analysts can:

- Query live remittance tapes via MCP discovery.

- Embed lineage pointers directly into chart objects (e.g.,

).link://dealcharts/transactions - Generate ABS surveillance charts and summaries in seconds—without rebuilding pipelines.

Dealcharts’s open context graph and API modules ensure every insight is verifiable, compliant, and ready for investor reporting or risk committees.

Conclusion

The Model Context Protocol (MCP) for enterprise AI brings order to structured-finance workflows—unifying tools, resources, and prompts under a governed, auditable framework. By embedding context tokens, lineage pointers, and dynamic discovery, MCP elevates LLM reasoning, risk monitoring, and compliance. Paired with CMD+RVL’s context engines and Dealcharts’s open dataset ecosystem, MCP empowers teams to deliver reproducible, explainable analytics—transforming ABS surveillance, tranche-level analysis, and executive reporting from manual toil into seamless, real-time workflows.

Article created using Outrank