A Guide to BDCs

What Is a Business Development Company?

A Business Development Company (BDC) is a publicly traded investment vehicle that provides capital to small and mid-sized private businesses. It allows individual investors to access private credit and private equity markets through shares traded on a public stock exchange.

In essence, BDCs pool capital from investors and deploy it as debt and equity to private companies.

Business Development Company Fundamentals

BDCs function by investing pooled capital into private companies, typically those with enterprise values under $250 million. Income generated from these debt and equity investments is then distributed to the BDC's shareholders, primarily as dividends.

The operational model is defined by several key parameters:

- Publicly Traded: BDC shares are bought and sold on public exchanges, providing liquidity to investors.

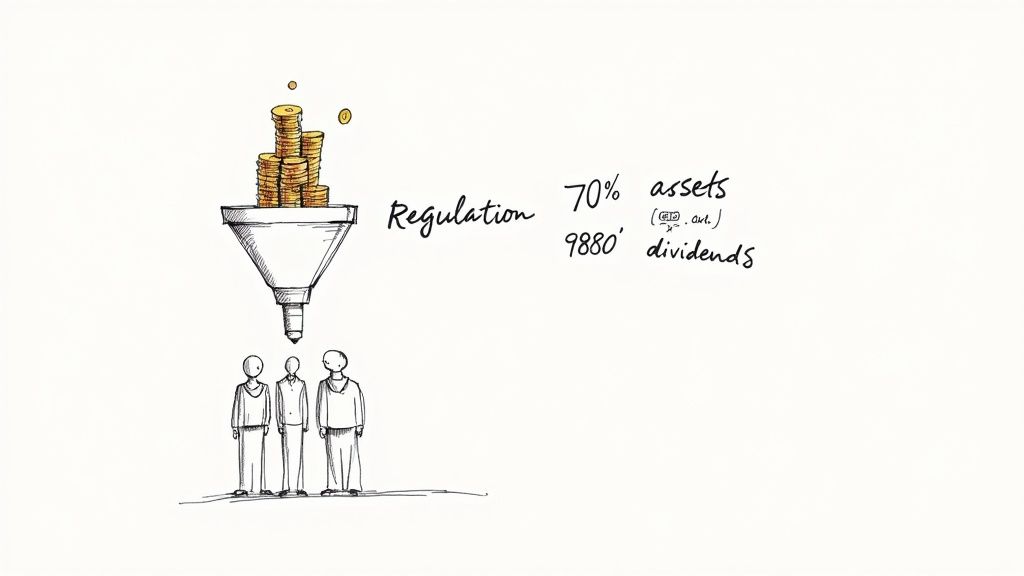

- Investment Mandate: At least 70% of a BDC's assets must be invested in qualifying U.S.-based companies.

- Dividend Distribution: As Regulated Investment Companies (RICs), they must distribute at least 90% of their taxable income to shareholders.

- Asset Composition: Portfolios typically consist of senior secured loans, subordinated debt, and equity positions.

Origins and Purpose

The BDC structure was established by the U.S. Congress in 1980 through amendments to the Investment Company Act of 1940. The primary objective was to stimulate capital investment in small and developing businesses that might not have access to traditional financing from banks.

By design, BDCs focus on companies with a market value under $250 million, addressing a critical funding gap in the economy.

Their function serves two main purposes:

- Provide investors with access to income-producing private investments.

- Supply capital to smaller companies to support growth and job creation.

This structure positions BDCs as an intermediary between public capital markets and private enterprise. For further historical context, this report offers a great overview of BDC origins.

BDC Core Characteristics at a Glance

BDCs operate within a specific framework that differentiates them from other investment entities.

A BDC can be understood as a publicly traded, closed-end fund that provides retail investors with exposure to private market investments, similar to those held by venture capital or private equity funds.

The following table summarizes their essential attributes.

| Attribute | Description |

|---|---|

| Legal Form | A closed-end investment company. |

| Regulation | Governed by the Investment Company Act of 1940. |

| Asset Focus | Minimum 70% in small/mid-sized U.S. firms. |

| Leverage | Subject to asset coverage ratio requirements. |

| Tax Status | Typically a pass-through entity as a Regulated Investment Company (RIC). |

These attributes collectively define a BDC's operations, risk profile, and potential return characteristics for shareholders.

Why BDCs Matter

BDCs serve both investors and businesses. They aim to deliver high-yield distributions to shareholders while providing flexible capital to companies that may not qualify for traditional bank financing.

For investors, this provides access to private credit investments with the transparency of SEC-regulated filings and the potential for a consistent income stream. For the portfolio companies, it provides necessary growth capital often without the rigid covenants of traditional bank loans.

- Exposure to private credit assets typically reserved for institutional investors.

- Transparent financial reporting through required SEC filings.

- Potential for high dividend yields.

- Portfolio diversification across private debt and equity.

The next section examines the legal and tax structures that govern BDC operations.

The Rules of the Road: BDC Regulatory and Tax Structure

A Business Development Company is a specific legal entity defined by a distinct regulatory and tax framework. BDCs are governed by the Investment Company Act of 1940, which establishes the rules for their investment activities and financial management.

This act sets parameters on asset composition and leverage, balancing investor protection with the goal of directing capital to smaller American businesses. Understanding these regulations is fundamental to comprehending the BDC model.

The Pass-Through Tax Advantage

A key feature of the BDC structure is its tax treatment as a Regulated Investment Company (RIC). This status allows the BDC to avoid corporate-level income tax on its earnings, provided it meets specific distribution requirements.

The RIC status mandates that the BDC functions as a conduit, passing its income directly through to its shareholders.

To maintain RIC status, a BDC must distribute at least 90% of its taxable income to shareholders. This distribution is typically paid as dividends, which is the primary reason BDCs are known for high yields.

This pass-through structure creates a direct link between the BDC's portfolio income and investor returns. The dividends are generally taxed as ordinary income for the shareholder.

Core Regulatory Mandates

The 1940 Act establishes several operational requirements that define a BDC's strategy and financial structure.

Two regulations are particularly significant:

-

The 70% Asset Requirement: This rule mandates that at least 70% of a BDC’s total assets must be invested in "eligible portfolio companies." These are typically private U.S. companies or public companies with a market capitalization under $250 million. This ensures BDCs remain focused on their core mission of funding small and mid-sized businesses.

-

The Asset Coverage Ratio: This regulation limits the amount of leverage a BDC can use. Historically, the requirement was 200% asset coverage (a 1:1 debt-to-equity ratio). Recent legislation allows BDCs, with board approval, to reduce this ratio to 150% (a 2:1 debt-to-equity ratio). This permits increased leverage, which can amplify returns but also increases financial risk.

To understand a BDC, one must analyze its balance sheet. This reveals its investment strategy, sources of income, and areas of risk.

BDCs are significant participants in the global private credit market, which exceeded $1.5 trillion in assets under management in 2022. This illustrates the critical role these entities play in financing companies outside the traditional banking system. For further market context, Barings provides an in-depth market analysis on the state of BDCs and private credit.

The Asset Side: What a BDC Owns

The asset side of the balance sheet details a BDC's investments. A typical BDC portfolio consists primarily of debt and equity investments in the small and mid-sized businesses it finances.

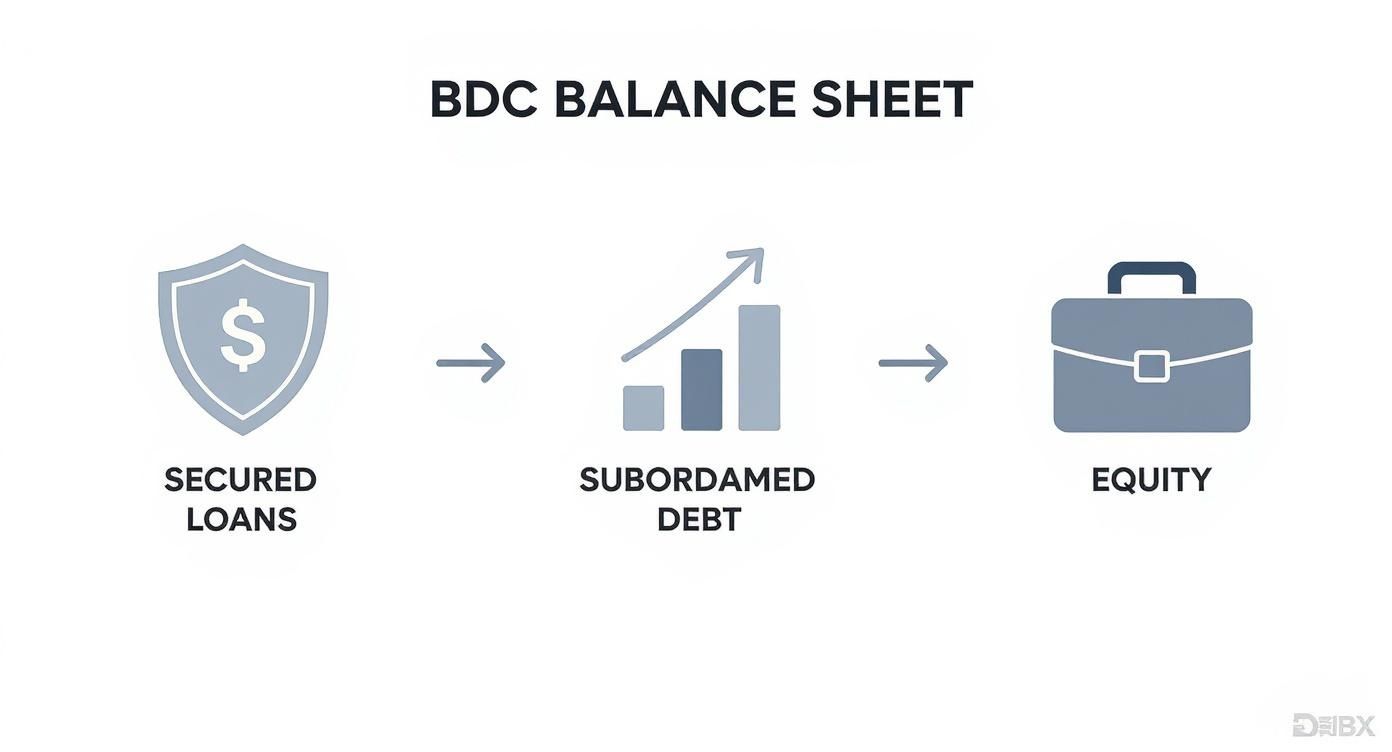

Debt instruments form the core of most BDC portfolios and are categorized by seniority, which determines the priority of repayment in a default scenario.

-

First-Lien Senior Secured Loans: These are the most senior debt instruments in a company's capital structure. They are secured by the borrower's assets and have the first claim on repayment in the event of default, representing lower risk and generating stable returns.

-

Second-Lien Loans: These loans are also secured by collateral but are subordinate to first-lien debt in the repayment hierarchy. They offer higher yields to compensate for this increased risk.

-

Mezzanine & Unsecured Debt: This category includes subordinated debt that may have equity-like features, such as warrants. These instruments are typically unsecured and carry higher interest rates to reflect their greater risk and potential for upside.

-

Equity Investments: These are direct ownership stakes in portfolio companies. They carry the highest risk, as their value can go to zero if the company fails, but also offer the greatest potential for capital appreciation.

The Liability Side: What a BDC Owes

The liability side of the balance sheet shows how a BDC finances its investments. Leverage is used to enhance returns but must be managed within regulatory limits.

A BDC’s liability structure is its financial engine. The cost and stability of this funding directly impact the profitability and risk profile of its entire investment portfolio.

Common sources of funding include:

- Bank Credit Facilities: These are revolving lines of credit from banks, typically representing a flexible and low-cost source of financing.

- Unsecured Notes: These are corporate bonds issued by the BDC to investors. They usually have fixed interest rates and multi-year maturities, providing stable, long-term capital.

- Preferred Equity: This is a hybrid security that has characteristics of both debt and equity. It pays a fixed dividend and is subordinate to debt but senior to common stock.

By managing this mix of assets and liabilities, a BDC constructs a portfolio designed to generate income while managing default risk, thereby supporting its dividend distributions to shareholders.

Assessing BDC Performance and Value

https://www.youtube.com/embed/SEZNjrT1Upw

Dividend yield alone can be a misleading indicator of a BDC's health. A thorough assessment requires analyzing metrics that reflect the true value and performance of its underlying loan portfolio.

What's a BDC Really Worth? Net Asset Value (NAV)

The primary valuation metric is Net Asset Value (NAV) per share. NAV represents the BDC's per-share liquidation value. It is calculated by taking the fair market value of all assets, subtracting total liabilities, and dividing the result by the number of outstanding shares.

This figure serves as a baseline for the BDC's intrinsic worth. A BDC's stock price may trade at a premium or a discount to its NAV, reflecting market sentiment about its management, future prospects, and portfolio risk.

Gauging Earning Power and Stability

While NAV provides a static valuation, Net Investment Income (NII) measures a BDC's core profitability over a period. NII is calculated by subtracting all operating expenses, including management and incentive fees, from the total income generated from interest and dividends.

NII indicates a BDC's ability to generate cash from its investments before accounting for capital gains or losses.

A stable or increasing NII suggests a healthy, income-producing portfolio. It is also the key determinant of dividend sustainability. The dividend coverage ratio, calculated by dividing NII per share by the dividend per share, measures this. A ratio consistently above 1.0x indicates that the BDC is earning more than it distributes to shareholders.

The relationship between NAV and NII is critical. Consistent NII can protect and grow NAV over time. Conversely, a declining NAV, often caused by credit losses, signals a threat to the BDC's income-generating capacity.

The infographic below illustrates the typical asset composition that generates a BDC's income, balancing income-producing secured loans with higher-risk equity positions.

This visual demonstrates the trade-off between predictable income from debt and the capital appreciation potential of equity.

Analyzing Fees and Portfolio Health

Operating expenses, particularly management fees, significantly impact shareholder returns. Most externally managed BDCs utilize a two-part fee structure that directly reduces NII:

- Base Management Fee: An annual fee, typically ranging from 1.0% to 1.75% of the BDC’s gross assets.

- Incentive Fee: A performance-based fee, commonly 20% of income above a specified hurdle rate, and sometimes an additional fee on capital gains.

These fees can substantially reduce the income available for distribution to shareholders. Therefore, comparing fee structures is an important part of BDC analysis.

Finally, monitoring NAV performance over time provides insight into the management team's underwriting capabilities. A stable or growing NAV is an indicator of sound credit selection. For example, a DBRS Morningstar review of the BDC space noted that in Q4 2021, the average BDC NAV increased by 0.5% quarter-over-quarter, indicating portfolio stability during a period of market volatility.

Combining analysis of NAV trends, NII, dividend coverage, and fees provides a comprehensive assessment of a BDC's value.

Identifying Risks in BDC Investments

The high yields offered by BDCs are accompanied by specific risks inherent in their business model and investment focus. Understanding these potential downsides is essential for any investor.

These risks can directly affect a BDC’s Net Asset Value (NAV), its income generation, and the sustainability of its dividend payments.

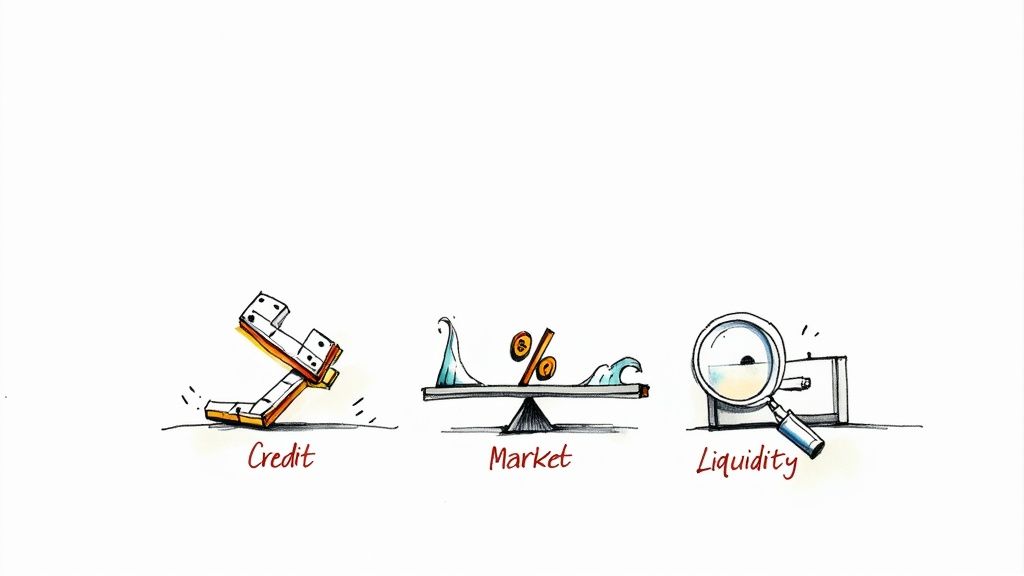

Credit and Default Risk

The primary risk is credit risk, which is the possibility that a portfolio company will be unable to repay its loan. Because BDCs lend to smaller, often non-investment-grade businesses, this risk is a material factor.

A default by a portfolio company requires the BDC to write down the value of that loan. This action directly reduces NAV and curtails the BDC's income stream, which in turn jeopardizes its ability to pay dividends.

An increase in non-accrual loans—loans on which interest payments are no longer being made—is a key indicator of deteriorating credit quality within a BDC's portfolio and should be monitored closely in quarterly reports.

Interest Rate and Market Risk

As financial entities, BDCs are exposed to macroeconomic factors like changes in interest rates. This interest rate risk has a dual effect. Rising rates can increase income from a BDC's floating-rate loans, but they also increase the BDC’s own borrowing costs.

The net impact depends on how well management has structured the BDC's balance sheet. Additionally, general market risk affects BDCs. Economic downturns can depress the value of equity investments and degrade the credit quality of the entire loan portfolio.

Leverage and Valuation Risk

Leverage can amplify returns, but it also magnifies losses. A BDC that uses significant debt to finance its investments faces substantial risk if the value of its portfolio declines. A small drop in asset value can lead to a much larger percentage decrease in NAV for a highly leveraged BDC.

Finally, valuation risk is a subtle but significant concern. A large portion of a BDC’s assets are illiquid private investments without daily market prices.

- Subjective Valuations: The BDC's management team is responsible for determining the "fair value" of these private loans and equity stakes on a quarterly basis.

- Potential for Overstatement: These valuations are estimates and may be slow to reflect a decline in a portfolio company's financial health.

- Impact on NAV: If market conditions reveal that assets were overvalued, the BDC’s NAV can experience a sudden and significant downward correction.

The Bottom Line on Business Development Companies

A Business Development Company is a publicly traded entity designed to provide capital to small and medium-sized American businesses. The structure gives individual investors access to private credit and equity markets, which were historically dominated by institutional investors. BDCs aim to deliver high-yield dividends to shareholders by financing the growth of developing companies.

Their operations are governed by strict regulations. Key rules require that at least 70% of assets be invested in eligible private companies and that 90% of taxable income be distributed to shareholders as dividends. This pass-through tax model is a primary attraction for income-oriented investors.

A BDC is a regulated vehicle that directs public capital to private companies, generating high-yield income in return. Its success depends on management's ability to select sound investments and manage leverage effectively.

When evaluating a BDC, several key metrics provide insight into its financial health:

- Net Asset Value (NAV) per share: The underlying book value; its trend over time is a critical indicator.

- Net Investment Income (NII): A measure of the BDC's core profitability from its investment portfolio.

- Dividend Coverage Ratio: Determines whether NII is sufficient to cover the dividend payment. A ratio below 1.0x may signal that the dividend is unsustainable.

The high yield potential of BDCs comes with commensurate risks, including credit defaults, interest rate fluctuations, and the impact of leverage. A thorough analysis requires weighing the potential return against these inherent risks.

A Few Common Questions About BDCs

Several specific questions frequently arise regarding the function and characteristics of BDCs.

Are BDC Dividends Qualified for Lower Tax Rates?

Generally, no. BDCs are structured as Regulated Investment Companies (RICs), meaning they do not pay corporate-level tax and pass income directly to shareholders.

Consequently, BDC dividends are typically classified as non-qualified ordinary income. They are therefore taxed at the investor's standard income tax rate, which is higher than the preferential rate for qualified dividends. While a small portion of a distribution may occasionally be classified as a return of capital or a long-term capital gain, investors should expect the majority of the dividend to be taxed as ordinary income.

How Do BDCs Hold Up in a Downturn?

In an economic downturn, a BDC's performance depends on the credit quality of its portfolio and the expertise of its management. A recession increases the likelihood of default among the small and mid-sized businesses that BDCs finance, which puts downward pressure on a BDC’s Net Asset Value (NAV).

During such periods, BDC share prices often trade at significant discounts to their NAV. However, performance varies. BDCs with portfolios concentrated in senior-secured, first-lien loans and that adhere to disciplined underwriting standards tend to demonstrate greater resilience. The key test is management's ability to manage and restructure problem loans during a credit cycle.

An internally managed BDC often presents a structure with fewer inherent conflicts of interest and potentially lower operating costs, as the management team is directly employed by the BDC itself.

What’s the Difference Between Internal and External Management?

The management structure directly affects operating costs and the alignment of interests between management and shareholders.

An internally managed BDC functions like a standard corporation with its own employees and executives. This structure often results in lower total expenses and a more direct alignment with shareholder interests.

An externally managed BDC contracts with a third-party investment advisor to manage its portfolio. This advisor receives a base management fee (typically a percentage of assets) and an incentive fee based on performance. While an external manager may offer specialized expertise, this fee structure can be more costly and may introduce potential conflicts of interest.

Article created using Outrank