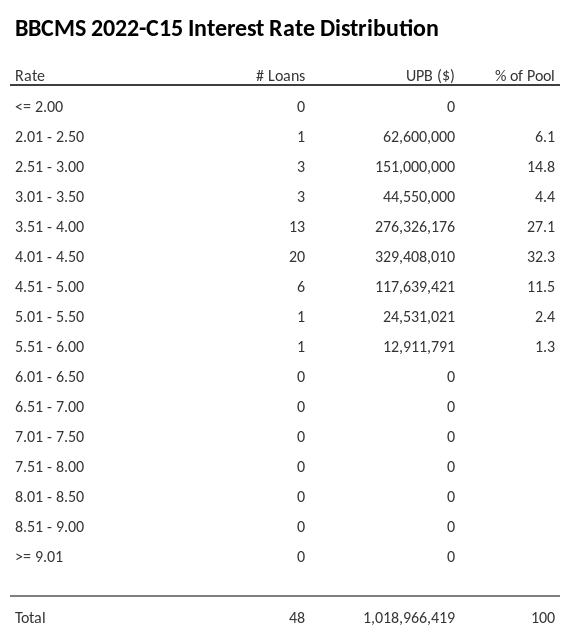

BBCMS 2022-C15 — Interest Rate Distribution | Dealcharts

BBCMS 2022-C15 has 32.3% of its pool with interest rates 4.01 - 4.50. Free CMBS chart for BBCMS 2022-C15. Updated from SEC EDGAR filings.

📊 Chart Summary

BBCMS 2022-C15 has 32.3% of its pool with interest rates 4.01 - 4.50, totaling $329,097,764 in unpaid principle balance according to Edgar sec.gov filings. The reporting period for this information begins 2025-12-12 and ends 2026-01-12.

Prompts

Explore a variety of thoughtfully crafted prompts below, each tailored for specific use cases. Each card includes a convenient copy-paste button that lets you seamlessly transfer the prompt into your favorite AI tool. Whether you're using ChatGPT, Microsoft Copilot, Gemini, Grok, Perplexity, or Claude, these prompts are designed to help you unlock new insights and ideas. Simply click 'Copy' to get started!

Summarize Interest Rate Distribution

Highlight Outliers

Cluster Interest Rates

Compare to Market Averages

Visualize Weighted Average Interest Rate

Highlight Risk Concentration

Create a Heatmap of Loan Counts

Generate a Tail Risk Analysis

Get the data

Dataset used to create this chart

Exact curated dataset used to create this chart and other charts on this site.

XML datasets for CMBS deals

Raw XML filings from sec.gov that include this data and more for in-depth analysis.

CREFC IRP standardized datasets

Get the standardized dataset following the CREFC IRP format, ideal for advanced reporting and analysis.