Apollo Commercial Real Estate

Deconstructing Apollo Commercial Real Estate: From Filings to Loan Tapes

Apollo Commercial Real Estate Finance, Inc. (NYSE: ARI) is a critical player in structured finance, acting as a real estate investment trust (REIT) specializing in originating, acquiring, and managing commercial real estate (CRE) debt. For analysts monitoring credit markets, understanding ARI's loan book is essential, as their originations often become the collateral for new Commercial Mortgage-Backed Securities (CMBS) deals. Tracking this flow from origination to securitization requires a verifiable, data-driven approach. This guide breaks down how to programmatically analyze apollo commercial real estate using public filings to build a clear data lineage, a process that can be visualized and cited using platforms like Dealcharts.

Market Context: ARI's Role in CMBS Origination

For quants and analysts, Apollo Commercial Real Estate functions as a key engine for loan origination, directly influencing the composition of collateral pools in new CMBS issues. Unlike equity REITs that own physical properties, ARI operates as a mortgage REIT (mREIT), generating income from interest on commercial loans rather than rent. Its primary advantage stems from its affiliation with Apollo Global Management, a connection that provides access to complex, large-scale transactions and deep market intelligence unavailable to smaller, independent lenders. This unique position makes ARI’s loan portfolio a rich source of data for modeling credit risk and market trends. The challenge for analysts is moving beyond high-level quarterly summaries to create structured, verifiable datasets from ARI's public disclosures.

Data Lineage: From SEC Filings to Verifiable Insights

Any rigorous analysis of a public company like ARI must be built on verifiable data lineage, with primary sources being its SEC filings. Investor presentations offer a narrative, but the ground truth resides in legally binding documents. For analysts building models or running surveillance, connecting claims back to their source is non-negotiable.

The key data sources for ARI are:

- Form 10-K (Annual Report): Provides a comprehensive yearly overview, including audited financials and detailed breakdowns of the loan book.

- Form 10-Q (Quarterly Report): Offers a fresher snapshot of the portfolio, detailing recent originations, paydowns, and shifts in asset quality.

- Form 8-K (Current Report): Discloses material events between reporting periods, such as significant new loans, asset sales, or changes to credit facilities.

Triangulating data across these filings allows an analyst to construct a verifiable timeline of ARI's lending activity, moving beyond marketing claims to hard numbers. A statement about "disciplined underwriting" in a presentation can be validated by cross-referencing weighted-average LTVs and property type concentrations in the latest 10-Q loan portfolio tables. This practice ensures every data point in a model is traceable and defensible.

Example Workflow: Programmatic Origination Tracking

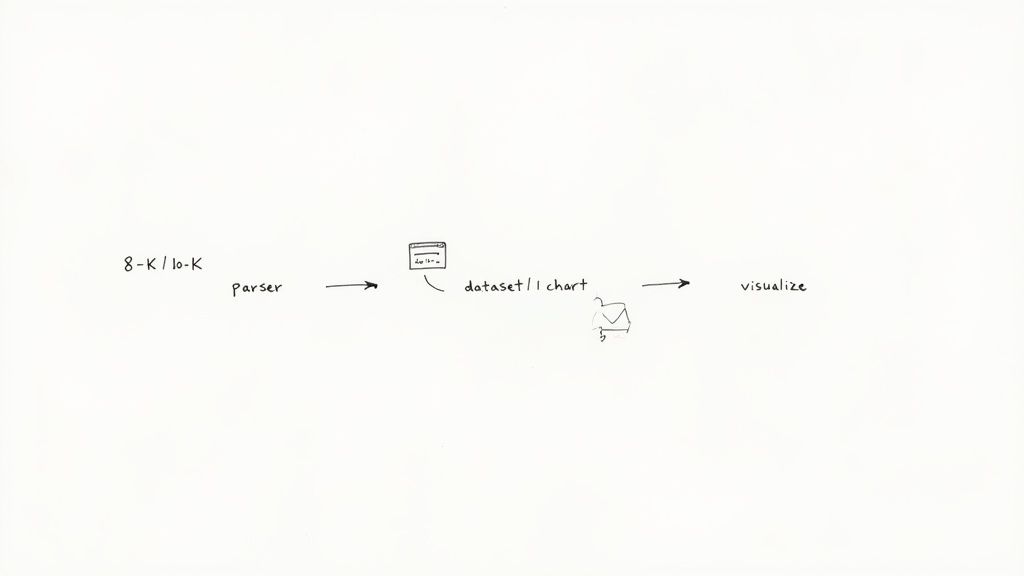

Manually extracting data from SEC filings is inefficient and error-prone. A programmatic workflow is essential for building a scalable, verifiable picture of an originator’s loan book. The process follows a standard data pipeline: source → transform → insight.

- Source: Programmatically ingest ARI's 8-K filings using an EDGAR API. These filings often contain press releases announcing new loan originations.

- Transform: Use text parsing techniques (e.g., regular expressions or NLP models) to extract key data points like loan amount, property type, location, and closing date from the unstructured text.

- Insight: Load the extracted data into a structured format, like a Pandas DataFrame, for aggregation and analysis.

Here is a simplified Python snippet demonstrating the transformation step:

import reimport pandas as pd# This script demonstrates parsing text from an 8-K filing to extract loan details.# Assume 'filing_text' contains the raw text of an ARI 8-K.filing_text = """Item 8.01 Other Events.On December 20, 2024, Apollo Commercial Real Estate Finance, Inc. (the 'Company')originated a $125.0 million first mortgage loan for a multifamily property in Austin, TX."""# Regex pattern to find the loan amount and property type.# Source -> Filing Text | Transform -> Regex Extractionloan_pattern = re.compile(r"originated a \$([\d\.]+) million .*? for a (\w+) property")matches = loan_pattern.findall(filing_text)# Insight -> Structure the data in a DataFrameif matches:df = pd.DataFrame(matches, columns=['Loan_Amount_M', 'Property_Type'])print("Extracted Loan Data:")print(df)# Output:# Extracted Loan Data:# Loan_Amount_M Property_Type# 0 125.0 multifamily

This simple workflow turns unstructured disclosures into a proprietary dataset. By applying this script across all relevant filings, an analyst can build a near real-time feed of ARI’s origination activity, providing a powerful input for credit models or market surveillance dashboards. The data lineage is clear: each row in the final dataset can be traced back to a specific source filing.

Implications: Building Model-in-Context Frameworks

This kind of structured context—linking an originator to its specific loans and then to the securities they back—is fundamental to building "model-in-context" frameworks. When a model can access not just a loan's LTV but also the originator's filing history, the underwriter’s commentary from the 10-Q, and the performance of its other loans in deals like the BMARK 2024-V9 CMBS deal, its predictive power increases dramatically. Explainable pipelines, where every data point has a clear lineage, allow analysts to defend their assumptions and enable LLMs to reason over financial data with greater accuracy. This moves analysis from isolated data points to an interconnected graph of verifiable information, a core principle of CMD+RVL's context engine approach.

How Dealcharts Helps

Dealcharts connects these disparate datasets—filings, deals, shelves, tranches, and counterparties—so analysts can publish and share verified charts without rebuilding data pipelines. Instead of manually linking an ARI 8-K to a CMBS prospectus, the platform provides a pre-built knowledge graph where these connections are already established. This accelerates research by allowing analysts to navigate from an originator like ARI to the specific CMBS vintages it contributed to, tracing the full data lineage with a few clicks.

Conclusion

Ultimately, a deep understanding of Apollo Commercial Real Estate requires moving beyond surface-level metrics and building a research process grounded in verifiable data lineage. By programmatically parsing primary source documents like SEC filings, analysts can create structured, auditable datasets that power more sophisticated models and generate defensible insights. This data-first, explainable approach is the foundation for navigating the complexities of modern credit markets, a framework enabled by CMD+RVL's broader vision for reproducible finance analytics.

Ready to build your own verifiable, context-rich analysis? Dealcharts connects public filings, deals, shelves, tranches, and counterparties into a single, navigable graph. Explore the data and build publication-ready charts at https://dealcharts.org.

Article created using Outrank