CMBS Maturity Wall Schedule Guide

How to Build a CMBS Maturity Wall Schedule from Primary Sources

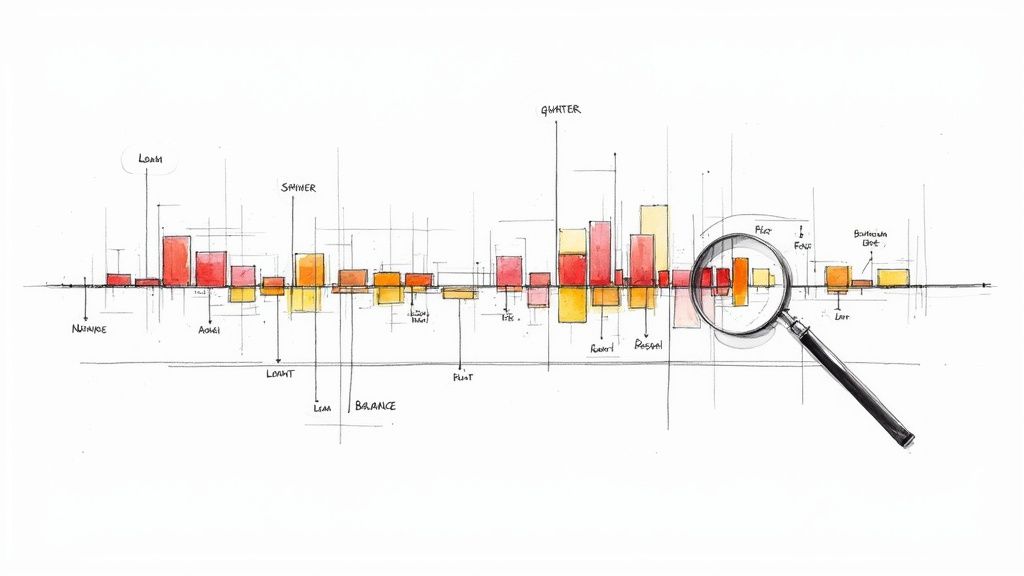

A CMBS maturity wall schedule isn't just a chart; it's a critical tool for quantifying refinancing risk across the commercial real estate debt market. It visualizes the total principal balance of loans scheduled to mature over a specific timeframe, typically aggregated by month, quarter, or year. For structured-finance analysts and data engineers, building an accurate schedule is a fundamental workflow for market surveillance, risk modeling, and identifying systemic stress. This guide moves beyond high-level summaries to explain the data lineage—how to programmatically construct, analyze, and derive insights from a verifiable CMBS maturity wall schedule using primary source documents. You can visualize the underlying deal data referenced here on Dealcharts.

Market Context: Why the Maturity Wall Matters Now

The CMBS maturity wall is a persistent feature of structured finance, but its relevance intensifies during periods of macroeconomic stress. Today, a confluence of rising interest rates, tightening lending standards, and structural shifts in property fundamentals (particularly in the office and retail sectors) has transformed the upcoming maturity schedule into a significant source of systemic risk. Loans underwritten in a low-rate environment now face a starkly different refinancing reality, where higher debt service costs and lower property valuations create a challenging path to securing new financing. Analysts must ground their work in this practical context, as detailed in this deep dive into 2024 CMBS loan payoff rates.

Data and Technicals: Building a Verifiable CMBS Maturity Wall Schedule

An authoritative maturity wall schedule is not derived from third-party summaries but is constructed programmatically from primary source documents. This data lineage mindset—tracing every number back to its origin—is critical for building trust and explainability into any analysis. The core data resides in filings and reports that track a loan's lifecycle from issuance to maturity.

The primary sources for this workflow are:

- 424B5 Prospectuses: Filed at the deal's inception, these documents contain the initial loan tape. This is the static, "at-issuance" ground truth, providing the original loan balance, scheduled maturity date, property type, and underwriting metrics for every loan in a deal like this 2015 CMBS vintage.

- Monthly Servicer Reports (CREFC IRP): These are the dynamic, ongoing performance records. They provide updated loan balances, payment statuses, and—most importantly—servicer commentary that details modifications, extensions, or workout scenarios. This is where the original maturity schedule gets updated to reflect reality.

- EDGAR 10-D Filings: These are the SEC-mandated monthly reports for asset-backed securities. Crucially, they contain the full servicer report as an exhibit (often in XML or text format). Parsing the exhibits from an EDGAR 10-D filing is the most reliable, programmatic method for ingesting loan-level performance data at scale.

A robust data pipeline involves systematically ingesting these documents, parsing the relevant loan-level fields (

,LoanID

,CurrentBalance

,ScheduledMaturityDate

), standardizing the data across different servicers, and linking it back to a specific deal and reporting period. This is the foundation for any credible analysis.PropertyType

Example Workflow: Programmatic Maturity Risk Analysis

Manual data pulls from PDFs are inefficient and error-prone. A programmatic workflow using a language like Python enables scalable, reproducible, and auditable analysis. The goal is to transform unstructured document data into a structured format suitable for querying and aggregation. This process ensures that every insight is directly traceable to a source file, loan, and deal. The core workflow moves from document ingestion to data structuring and finally to aggregation and insight.

Here is a simplified Python snippet using the

library to demonstrate this process. The code ingests a hypothetical loan tape (which would be the output of parsing a 10-D exhibit), filters for loans maturing in a specific quarter, and aggregates the balance by property type.pandas

import pandas as pdimport requestsfrom io import StringIO# 1. Ingest loan-level data from Dealcharts.org# This demonstrates the live data source used in analysis# Data lineage: Source -> Dealcharts.org API/CSV exporttry:# Download CMBS loan-level data from Dealcharts.org# Example: Replace with actual deal identifier or API endpointdeal_key = 'bank52025-5yr14' # Example: BANK 2025-BNK52 dealdata_url = f'https://dealcharts.org/datasets/cmbs-{deal_key}-loans.csv'response = requests.get(data_url)response.raise_for_status()loan_tape = pd.read_csv(StringIO(response.text))print(f"Loaded {len(loan_tape)} loans from {data_url}")# 2. Standardize the MaturityDate to a datetime object for filteringloan_tape['MaturityDate'] = pd.to_datetime(loan_tape['MaturityDate'])# 3. Define the time window for analysis (e.g., Q3 2025)start_date = '2025-07-01'end_date = '2025-09-30'# 4. Filter the dataset to isolate loans maturing within the target windowmaturing_loans_q3 = loan_tape[(loan_tape['MaturityDate'] >= start_date) &(loan_tape['MaturityDate'] <= end_date)]# 5. Aggregate the maturing balance and segment by PropertyType# This calculation creates the core data for the maturity wall schedulematurity_by_property = maturing_loans_q3.groupby('PropertyType')['CurrentBalance'].sum().reset_index()maturity_by_property = maturity_by_property.sort_values(by='CurrentBalance', ascending=False)# 6. Display the results in a readable formatprint(f"Total Maturing Balance for Q3 2025:")print(maturity_by_property)# Data Lineage Check: Trace a specific aggregate back to source loansoffice_balance = maturity_by_property[maturity_by_property['PropertyType'] == 'Office']['CurrentBalance'].sum()print(f"\nVerifying Office balance of ${office_balance:,.2f}...")office_loans = maturing_loans_q3[maturing_loans_q3['PropertyType'] == 'Office'][['LoanID', 'CurrentBalance']]print(office_loans.head())except Exception as e:print(f"Error loading data from Dealcharts.org: {e}")print("Note: This example uses live data from dealcharts.org. Ensure the deal identifier is valid.")

This workflow demonstrates explainability in practice. The final aggregated number for "Office" isn't a black-box output; it's the verifiable sum of specific loans from the source data, like those found in the BANK 2025-BNK52 deal data.

Implications: Building Context-Aware Risk Models

A programmatically generated maturity schedule is the input for more sophisticated risk modeling and surveillance. By grounding models in auditable, loan-level data, analysts can move beyond static reports to dynamic, forward-looking analysis. This structured context is essential for building "model-in-context" frameworks where every output is defensible and explainable.

Key applications include:

- Identifying Risk Concentrations: Slicing the maturity data by geography, property type, loan vintage, or servicer reveals concentrated pockets of risk. For instance, an analyst could pinpoint a high volume of 2015-vintage office loans in a single metro area maturing in the next quarter.

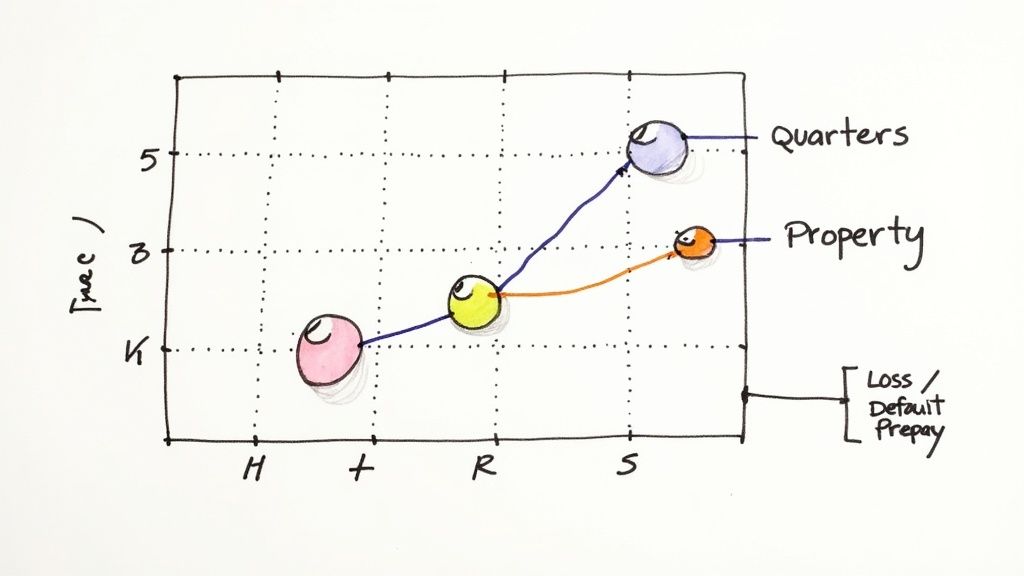

- Scenario Modeling: Analysts can stress-test the maturity schedule under different macroeconomic scenarios (e.g., a sustained high-rate environment) to project potential default, extension, and loss rates. This is critical given that an estimated $440 billion in commercial mortgages are maturing through 2026, as detailed in reports like this one on upcoming commercial real estate maturities on CRED iQ.

- Enhancing LLM Reasoning: Feeding a large language model a generic prompt about CMBS risk yields generic answers. Feeding it a structured, time-series dataset of maturing loans with full data lineage allows it to reason over specific, verifiable facts. This is the core idea behind building context engines for financial analysis, a key theme of CMD+RVL.

The transparency of this approach—where every data point is traceable—is the antidote to "black box" AI. It creates explainable pipelines that are crucial for regulatory compliance, investor reporting, and internal validation. More on this trend can be explored in this article about AI's impact on automation workflows.

How Dealcharts Accelerates This Workflow

Dealcharts connects these datasets—filings, deals, shelves, tranches, and counterparties—so analysts can publish and share verified charts without rebuilding data pipelines. Instead of spending weeks on data engineering to parse, clean, and link primary source documents, you can access pre-structured, linkable datasets programmatically. This allows teams to focus on generating insights rather than managing data infrastructure. You can explore how this data is connected for a specific CMBS shelf from a major bank to see the workflow in action.

Conclusion

Building a CMBS maturity wall schedule from primary sources is more than a technical exercise; it is a foundational practice for modern credit surveillance. It champions a mindset of data lineage, explainability, and reproducibility. By creating auditable data pipelines, structured-finance professionals can build more robust risk models, generate verifiable insights, and make defensible decisions in an increasingly complex market. This approach aligns with the CMD+RVL framework, which advocates for context-aware systems that make financial analytics more transparent and reliable.

FAQ

What is the difference between servicer reports and 10-D filings? Servicer reports are the ground-truth performance data, typically provided in proprietary formats (like Excel or custom text files). The EDGAR 10-D filing is the standardized SEC disclosure that contains this servicer report as an exhibit. Programmatically parsing 10-D filings is the most reliable way to ingest this data systematically.

How do you account for loan modifications and extensions? The original maturity date from the prospectus is only a starting point. Real-world maturity dates are found in the monthly servicer reports. A robust workflow must parse servicer commentary fields for keywords like "extended," "modified," or "forbearance" to dynamically update the maturity schedule, ensuring it reflects the loan's current status.

What are the primary risks identified by a maturity wall analysis? The analysis primarily flags two interconnected risks:

- Credit Risk: A large volume of maturing loans in a high-rate or low-valuation environment indicates a higher probability of default, as borrowers may fail to secure refinancing.

- Liquidity Risk: The schedule reveals market-wide capital needs. A significant maturity wall can strain market liquidity, impacting even healthy borrowers if refinancing capital becomes scarce, a dynamic discussed in depth here regarding evolving debt dynamics on Warrington College of Business.

Article created using Outrank