Defeasement of Bonds

Understanding the Defeasement of Bonds in Structured Finance

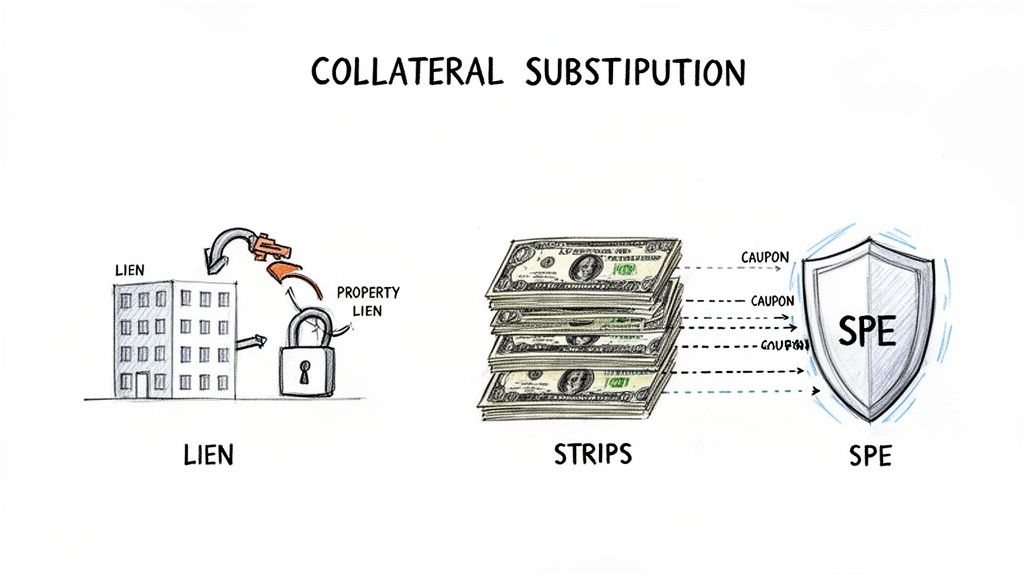

In structured finance, the defeasement of bonds is a critical mechanism for substituting collateral and de-risking a deal. An issuer removes debt from its balance sheet not by prepayment, but by replacing the original collateral—typically a commercial real estate asset—with a portfolio of government securities. This new collateral is placed in a bankruptcy-remote trust, with cash flows precisely matched to cover all remaining principal and interest payments. For analysts monitoring CMBS remittance data, a defeasance event is a powerful signal of credit enhancement, fundamentally altering a loan's risk profile. Visualizing this data lineage, from servicer report to deal impact, is where platforms like Dealcharts provide critical context.

Market Context: Why Defeasement Matters in CMBS

In Commercial Mortgage-Backed Securities (CMBS), defeasance is a core feature, distinct from simple loan prepayment. It is a structured collateral substitution that swaps the idiosyncratic risk of a commercial property for the credit risk of the U.S. government. For analysts and quants, this is not a minor accounting entry; it is a material change in the underlying asset's risk profile. When a loan tied to a property with variable rental income is defeased, its payments become backed by a dedicated portfolio of U.S. Treasury securities.

This process serves two primary functions in the market:

- Borrower Liquidity: It provides an exit for property owners who are otherwise prevented from prepaying their loan due to contractual "lockout periods."

- Credit Enhancement: It improves the credit quality of the entire CMBS trust. Removing a potentially volatile asset and replacing it with government-backed securities strengthens the collateral pool, often leading to credit rating upgrades for the associated bond tranches.

This mechanism is fundamental to the CMBS market, balancing borrower needs with investor demands for predictable returns. For analysts evaluating deals, such as those in the CMBS deals issued in 2018 vintage, identifying which loans have been defeased is crucial for accurate risk modeling and cash flow forecasting.

The Data Lineage of a Defeasement Event

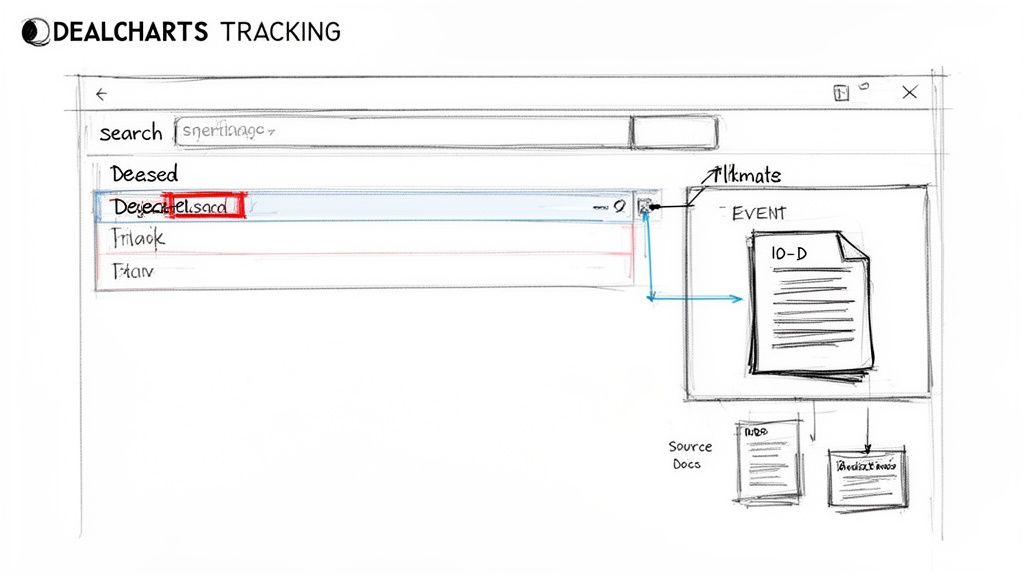

The data trail for a defeasance event originates in servicer reports, often filed as exhibits to SEC EDGAR 10-D filings for public ABS deals. These reports contain loan-level tapes that flag a loan's status change to "Defeased." From a data engineering perspective, the challenge is to programmatically extract this flag, link it to the correct loan within a specific deal CUSIP, and then propagate that change through any dependent risk models.

The process involves parsing unstructured or semi-structured data (like CREFC reports in XML or flat file formats) and linking it via identifiers like loan IDs and deal CIKs. The data lineage is critical:

- Source: Monthly servicer report (e.g., Exhibit 10-D).

- Extraction: A parser identifies the loan and the status flag change.

- Linking: The loan ID is mapped to the CMBS deal and its associated tranches (CUSIPs).

- Insight: The change in status triggers an update in cash flow models, shifting the loan's risk profile from property-backed to government-backed.

Platforms like Dealcharts are designed to manage this workflow by connecting filings, deals, and loan-level data, providing an auditable path from the source document to the analytical insight.

Example: A Programmatic Workflow for Tracking Defeasement

For a data engineer or quant analyst, automating the surveillance of defeasance events is a common workflow. The goal is to build a data pipeline that can ingest servicer reports, identify status changes, and update a loan database.

Here is a conceptual Python snippet demonstrating how one might flag a defeased loan and adjust its cash flow assumptions. This illustrates the core logic of transforming raw data into a structured, model-ready insight.

import pandas as pd# Sample loan tape DataFrame from a parsed servicer reportloan_data = {'loan_id': ['A1', 'B2', 'C3'],'deal_cusip': ['30294PAA1', '30294PAA1', '30294PAB9'],'property_noi_projection': [100000, 150000, 120000],'defeasance_status': ['Active', 'Defeased', 'Active'],'source_filing': ['10-D_202405.xml', '10-D_202405.xml', '10-D_202405.xml']}loan_tape = pd.DataFrame(loan_data)def adjust_cashflow_for_defeasement(row):"""Adjusts the cash flow source based on defeasance status.In a real model, this would pull from a pre-calculated Treasury portfolio schedule.This demonstrates the data lineage: source -> transform -> insight."""if row['defeasance_status'] == 'Defeased':# Source of truth is the defeasance flag.# Transformation: Replace property NOI with a guaranteed, risk-free cash flow.# This value would come from the defeasance portfolio schedule.return 145000 # Example fixed cash flow from Treasurieselse:# Use the original net operating income projectionreturn row['property_noi_projection']# Apply the function to create a new 'modeled_cashflow' columnloan_tape['modeled_cashflow'] = loan_tape.apply(adjust_cashflow_for_defeasement, axis=1)print("--- Model-Ready Loan Tape ---")print(loan_tape)# loan_id deal_cusip property_noi_projection defeasance_status source_filing modeled_cashflow# 0 A1 30294PAA1 100000 Active 10-D_202405.xml 100000# 1 B2 30294PAA1 150000 Defeased 10-D_202405.xml 145000# 2 C3 30294PAB9 120000 Active 10-D_202405.xml 120000

This simple transformation is a powerful example of an explainable pipeline. The

for loan 'B2' is no longer a projection based on real estate performance but a fixed value derived from the defeasance event, with a clear link back to itsmodeled_cashflow

.source_filing

Implications for Modeling and Risk Monitoring

Structuring data this way has profound implications for advanced modeling. When a defeasance event is captured as structured context, it dramatically improves the accuracy of risk models, pricing engines, and even Large Language Model (LLM) reasoning over financial documents.

A model that understands defeasance can correctly re-classify a loan's risk profile from commercial real estate credit risk to sovereign credit risk. This prevents material overestimation of credit losses in a CMBS pool. For LLMs, this structured context acts as a guardrail, enabling them to answer questions like, "Which loans in the BMO 2024-C7 pool have been de-risked?" with verifiable accuracy. This is a core theme of CMD+RVL: creating "model-in-context" systems where the data pipeline itself provides the explainability needed for reliable financial analysis.

How Dealcharts Helps

Dealcharts connects these datasets—filings, deals, shelves, tranches, and counterparties—so analysts can publish and share verified charts without rebuilding data pipelines. By structuring events like defeasance and linking them directly back to source documents, the platform provides the verifiable data lineage required for building trustworthy quantitative models and AI-powered analytical tools. This eliminates the manual, error-prone work of data extraction and reconciliation, allowing teams to focus on generating insight.

Conclusion

The defeasement of bonds is more than a legal maneuver; it is a fundamental data event in structured finance that signals a material change in credit risk. For analysts, data engineers, and quants, the ability to programmatically track these events with a clear, verifiable data lineage is essential for accurate modeling and surveillance. Frameworks like CMD+RVL and platforms like Dealcharts enable this by transforming raw market data into explainable, model-ready context, powering the next generation of financial analytics.

Diving Into the Legal Fine Print and Key Covenants

Defeasance isn't an automatic right. It's a privilege detailed in a deal's governing documents—typically the Pooling and Servicing Agreement (PSA). These documents dictate the exact terms under which collateral substitution is permitted.

- Lockout Periods: Most loans include a lockout period, often the first two years, during which defeasance is prohibited to ensure stable cash flows for investors.

- Successor Borrower Requirements: The documents specify that the Special Purpose Entity (SPE) holding the new collateral must be bankruptcy-remote.

- Collateral Eligibility: The PSA strictly defines acceptable replacement collateral, almost always limiting it to non-callable, direct obligations of the U.S. government.

Post-2008 crisis deals feature much stricter covenants. Analysts must examine the specific deal vintage and shelf documentation, like the offering documents for J.P. Morgan CMBS shelves, to verify defeasibility rules. A solid grasp of a contract law outline is helpful for interpreting these complex agreements.

For those building advanced analytical tools, see how AI-powered investment analysis tools are evolving. For a look at a specific deal, explore the BMO 2024-5C7 CMBS deal. The scale of global bond markets can be understood from resources like the International Capital Market Association.

Article created using Outrank