Interest Rate Cap

Deconstructing the Interest Rate Cap in CMBS Deals

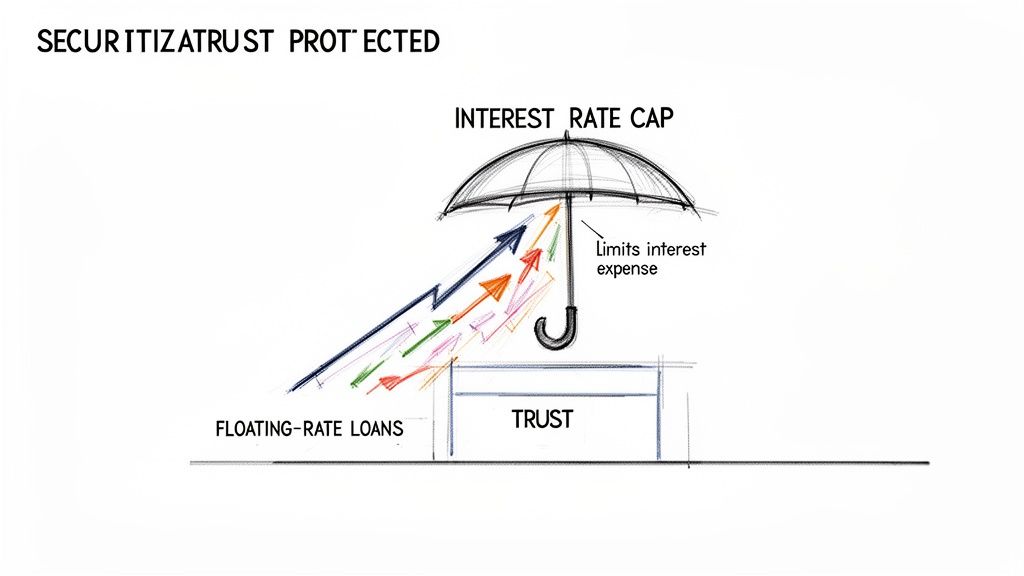

In structured finance, an interest rate cap is not a theoretical concept—it's a critical risk mitigant embedded in floating-rate deals. For analysts monitoring CMBS or ABS, the cap acts as an insurance policy, shielding a securitization trust from runaway financing costs when benchmark rates like SOFR rise. Understanding its mechanics is table stakes; programmatically accessing and verifying its parameters from source documents is what separates surface-level analysis from verifiable, model-ready insight.

The core challenge lies in data lineage: tracing the cap's strike, notional schedule, and counterparty from unstructured legal agreements in SEC filings to a structured format suitable for risk modeling. Dealcharts provides a way to visualize and cite this linked data, connecting the legal text to the deal's capital structure. This guide breaks down the data workflow for analyzing interest rate caps in a real-world context.

Market Context: Why Caps are Essential in CMBS

Interest rate caps are a non-negotiable component in most floating-rate CMBS deals. When a trust issues bonds tied to a floating rate, it must hedge the risk of that rate exceeding the income generated by its underlying fixed-rate mortgage collateral. Without a cap, a sharp rise in SOFR could create a cash flow deficit, jeopardizing payments to bondholders.

Rating agencies like Fitch or Moody's often mandate the inclusion of an interest rate cap as a form of credit enhancement. The cap's terms—particularly its strike rate and the creditworthiness of the counterparty providing it—are scrutinized to ensure the structure can withstand rate shocks. As seen in recent rate-hiking cycles, the cost and availability of these caps can directly impact deal feasibility and pricing. For analysts tracking the CMBS vintage 2024, verifying the cap's presence and provider is a primary step in due diligence, as a counterparty default exposes the trust to significant, unhedged risk.

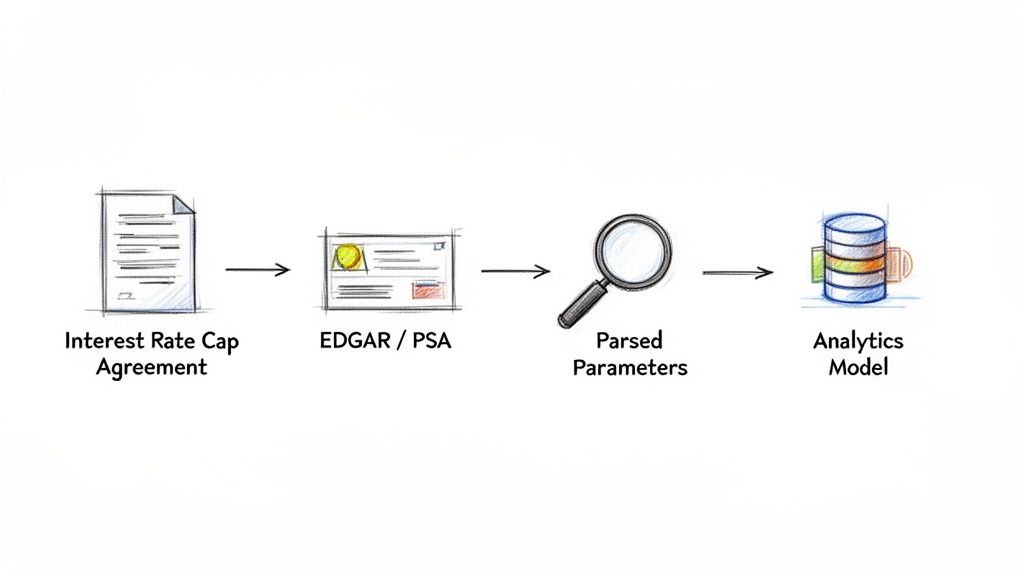

Data Lineage: From SEC Filings to Structured Parameters

The authoritative data for an interest rate cap resides in legal documents, typically filed as an exhibit to an SEC Form 8-K or embedded within the Pooling and Servicing Agreement (PSA). These PDFs contain the definitive parameters:

- Notional Principal Schedule: The principal amount the cap covers, which often amortizes over time.

- Cap Rate (Strike): The rate ceiling (e.g., 3.0% SOFR) that triggers a payment.

- Reference Index: The specific benchmark, such as 30-Day Average SOFR.

- Counterparty: The financial institution providing the cap.

- Termination Date: The date the agreement expires.

Sourcing this data programmatically requires a multi-step pipeline: identifying the correct CIK for a given deal, navigating EDGAR to find the relevant 8-K filings and exhibits, and then parsing the PDF documents. Manually, this process is tedious and error-prone. Platforms that automate data extraction are essential for scaling this workflow. Dealcharts, for instance, links these source documents directly to deal pages like the WFCM 2024-C63 example, creating a verifiable chain from legal text to analyzable data.

Example Workflow: Parsing Cap Details with Python

Once you have the source document, the next step is to extract its key parameters. While advanced tools can automate this, a simple Python script using a PDF library like

can demonstrate the core logic of finding and structuring the data.PyMuPDF

The goal is to transform unstructured text into a structured JSON object that can be fed into a database or analytical model.

import fitz # PyMuPDFimport redef extract_cap_details(pdf_path):"""Parses a PDF of an Interest Rate Cap Agreement to extract key terms.Note: Regex patterns are illustrative and must be adapted for specific document formats."""doc = fitz.open(pdf_path)text = ""for page in doc:text += page.get_text()# Illustrative regex patterns for key parametersnotional_pattern = re.compile(r"Notional\sAmount[:\s]*\$([\d,]+)")strike_rate_pattern = re.compile(r"Strike\sRate[:\s]*([\d.]+)%")counterparty_pattern = re.compile(r"between\s+(.*?)\s+\(the\s+\"Counterparty\"\)")details = {"notional": notional_pattern.search(text).group(1) if notional_pattern.search(text) else None,"strike_rate": strike_rate_pattern.search(text).group(1) if strike_rate_pattern.search(text) else None,"counterparty": counterparty_pattern.search(text).group(1) if counterparty_pattern.search(text) else None,"source_document": pdf_path}return details# --- Data Lineage in Action ---# Source: An 8-K exhibit PDF for a specific CMBS deal# Transform: The Python function extracts and structures the data.# Insight: The structured output can now be used for cash flow modeling.# Example usage (replace with actual PDF path)# cap_data = extract_cap_details("exhibit-10-1_cap_agreement.pdf")# print(cap_data)# Expected Output: {'notional': '100,000,000', 'strike_rate': '3.00', 'counterparty': 'Big Bank NA', 'source_document': '...'}

This workflow demonstrates explainability: every data point in the final JSON object is directly traceable to its source document, fulfilling the core principle of data lineage.

Implications for Modeling and AI

Having structured, verifiable data on the interest rate cap fundamentally improves analytical outcomes.

-

Risk Modeling: Cash flow models can simulate rate scenarios with precision. Instead of using assumed cap parameters, models can ingest the actual strike rate and notional schedule, leading to more accurate tranche valuations and stress tests. Knowing the cap provider, often a major bank issuer shelf, also allows for counterparty risk assessment.

-

LLM and Context Engines: For AI applications, this structured context is paramount. An LLM queried about a deal's rate sensitivity can provide a specific, fact-based answer if its context includes the verified cap details. This is the essence of a "model-in-context" approach, where the LLM reasons over structured, citable data rather than generating generic responses. This elevates its utility from a search tool to a genuine analytical partner.

How Dealcharts Helps

This entire data plumbing workflow—sourcing filings, linking them to deals, and structuring the parameters—is complex to build and maintain. Dealcharts connects these datasets—filings, deals, shelves, tranches, and counterparties—so analysts can publish and share verified charts without rebuilding data pipelines. By providing structured, citable data with clear lineage, it enables faster and more reliable analysis of instruments like the interest rate cap.

Conclusion

An interest rate cap is more than a simple derivative; it is a data-rich component whose parameters are critical for accurate risk assessment in structured finance. By adopting a data lineage mindset—programmatically sourcing terms from primary documents like SEC filings and structuring them for analysis—quants and data engineers can build models that are not only powerful but also explainable and reproducible. This foundational work enables higher-order applications, from precise cash flow forecasting to advanced, context-aware AI reasoning within frameworks like CMD+RVL.

The Mechanics of an Interest Rate Cap

To model a cap, you must understand its components. The cap itself is a portfolio of individual options on an interest rate, known as caplets. Each caplet corresponds to a specific payment period.

The payoff for a single caplet is determined by a simple formula:

Payoff = Max(0, Reference Rate − Strike Rate) × Notional × Day Count Fraction

This calculation ensures a payment is made only when the floating benchmark rate exceeds the predefined ceiling.

Core Cap Components

Every cap is defined by these key parameters, typically found in the legal agreement.

| Component | Description | Example Data Point |

|---|---|---|

| Notional Principal | The principal amount used for the payoff calculation. No principal is exchanged. | $100,000,000 |

| Cap Rate (Strike) | The interest rate ceiling that triggers a payoff. | 3.00% |

| Reference Index | The floating-rate benchmark, typically SOFR for modern deals. | 30-Day Average SOFR |

| Term (Tenor) | The full duration of the cap agreement. | 3 years |

| Payment Frequency | The interval for checking the reference rate (e.g., monthly). | Monthly |

| Day Count Fraction | The convention for calculating interest for a period (e.g., Actual/360). | 30/360 |

Efficiently parsing these details from unstructured PDFs is a common challenge, and knowing how to extract information from PDF files programmatically is a key skill for any quant or data engineer in this space.

Article created using Outrank