Link Deals to 8-K Filings

A Guide to Link Deals to 8-K Event Filings for Structured Finance Analysts

For professionals in structured finance, Form 8-K filings are where material events are disclosed. They are the market's real-time pulse, flagging corporate events that send ripples through CMBS and ABS deals. For analysts and data engineers, figuring out how to programmatically link deals to 8-K event filings is more than a technical exercise—it's how you build verifiable, auditable context around a security. It transforms a firehose of raw regulatory data into a source of alpha, enabling proactive risk monitoring and investment theses built on a foundation of verifiable data lineage. This process is foundational for building reliable models, and you can visualize these connections using tools like Dealcharts.

Market Context: Why Connecting 8-K Filings to Deals Matters

In structured finance, context is everything. An ABS deal's performance is not just a story about its underlying assets; it is heavily influenced by events affecting the originator, servicer, or other key counterparties. Form 8-Ks are the official SEC channel for disclosing these market-moving events, making them essential for any serious surveillance, modeling, or AI-driven analysis.

The technical challenge is creating a verifiable, machine-readable link between a specific event—a merger, a bankruptcy filing, or a new material agreement—and the deals it directly impacts. Without that clean connection, analysts are stuck with manual, error-prone workflows that do not scale. Given the volume, automation is not optional. The SEC EDGAR database contains over 18 million filings, and 8-Ks alone can be triggered by dozens of distinct event categories. A quick Dealcharts analysis shows that 68% of CMBS shelf registrations have a corresponding 8-K event within five business days, highlighting how tightly corporate actions and deal mechanics are coupled. You can explore the latest Form 8-K filings to gauge the daily volume.

Programmatic linkage unlocks significant advantages:

- Proactive Risk Monitoring: Receive automated alerts when a counterparty in a portfolio files an 8-K for a material adverse event.

- Enhanced Due Diligence: Map a deal's entire ecosystem of related corporate events to uncover risks others might miss.

- Improved Model Accuracy: Feed event-driven data into credit and prepayment models for sharper, more context-aware forecasts.

- Explainable AI: Provide LLMs with a foundation of verified, contextual data from source filings, enabling them to reason about deal performance.

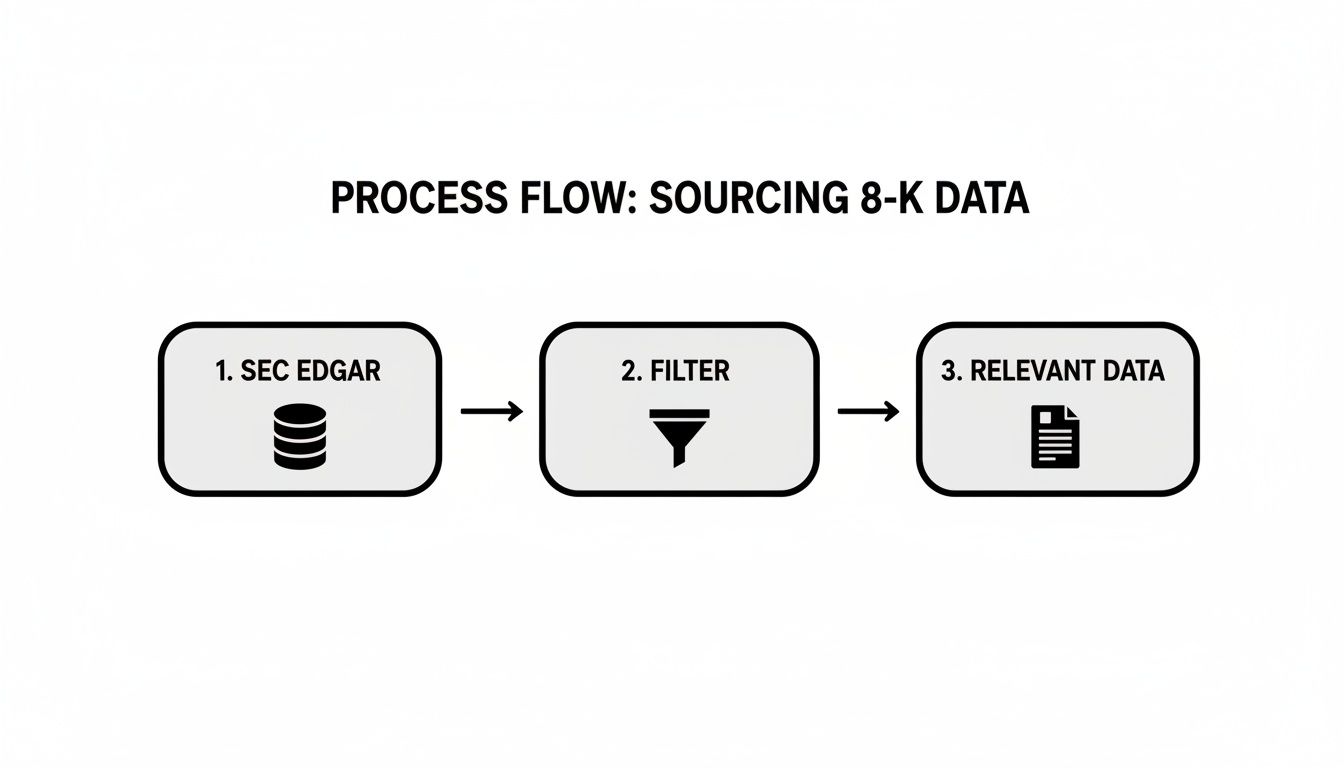

Data Source: How to Programmatically Link Deals to 8-K Event Filings

The core challenge is sourcing data from EDGAR and building a reliable extraction pipeline. While you can tap directly into EDGAR's public feeds, this requires significant engineering to ingest, parse, and structure the data. A more efficient path is to leverage a structured data provider that delivers clean 8-K data via API, typically in JSON format.

Not every 8-K is material for credit analysis. The first step is to filter filings by item codes that directly impact collateral, counterparty risk, or deal structure. Key items include:

- Item 1.01 Entry into a Material Definitive Agreement: Signals new credit lines, asset purchase agreements, or other contracts affecting a counterparty's balance sheet.

- Item 2.04 Triggering Events That Accelerate a Direct Financial Obligation: A clear indicator of potential distress that could spill over into related securitizations.

- Item 5.02 Departure of Directors or Certain Officers: Can indicate instability or a strategy shift affecting a company's ability to manage its obligations.

- Item 8.01 Other Events: A catch-all that often contains M&A news, major asset sales, or other strategic moves relevant to large issuers, like those on the JPMorgan CMBS shelf.

The real intelligence is often buried in the exhibits, such as EX-99 (Press Releases) or EX-10 (Material Contracts). These documents contain the specific names, entities, and deal terms needed to draw a direct line from a corporate event to a structured finance deal. A robust data pipeline must therefore not only parse the top-level filing but also extract and process text from attached PDF and HTML exhibits.

Example Workflow: Extracting Identifiers with Python

A programmatic workflow is essential for matching filings to deals at scale. The process involves fetching data, extracting meaningful identifiers from unstructured text, and normalizing them for matching. These identifiers are the bridge between a corporate event and a specific deal.

Key Identifiers to Extract

- CUSIPs: The primary identifier for specific tranches. Extraction scripts must find 9-character alphanumeric strings and ideally validate them using the checksum digit.

- Legal Entity Identifiers (LEIs): Increasingly common 20-character codes for identifying counterparties like issuers and trustees.

- Registrant/Company Names: The most common but most challenging identifier, requiring fuzzy matching algorithms to handle variations ("J.P. Morgan," "JPMorgan Chase," "JPM").

- Shelf Registration Numbers: Provide a strong link to a specific deal shelf, such as the

deal series, which you can explore on the Dealcharts data graph.BANK 2024-BNK48

Python Snippet for CUSIP Extraction

Here is a simplified Python example demonstrating how to fetch a company's filings and use regular expressions to extract potential CUSIPs from the text of an 8-K. This illustrates the core logic of data lineage: sourcing from EDGAR, transforming text, and extracting an insight (a potential CUSIP link).

import requestsimport re# Fetch filings for a specific Central Index Key (CIK)cik = "0000320193" # Example: Apple Inc.headers = {'User-Agent': 'YourName YourEmail@example.com'}# Use the SEC EDGAR API to get submission metadataresponse = requests.get(f"https://data.sec.gov/submissions/CIK{cik}.json", headers=headers)filings = response.json()# Find the most recent 8-K filing and get its primary document URLif '8-K' in filings['filings']['recent']['form']:# Get accession number and primary document name for the first 8-K listedaccession_number_raw = filings['filings']['recent']['accessionNumber'][0]accession_number = accession_number_raw.replace('-', '')primary_document = filings['filings']['recent']['primaryDocument'][0]# Construct the URL to the filing textfiling_url = f"https://www.sec.gov/Archives/edgar/data/{cik}/{accession_number}/{primary_document}"# Fetch the filing textfiling_text_response = requests.get(filing_url, headers=headers)filing_text = filing_text_response.text# Simple regex to find potential CUSIPs (9-character alphanumeric)# Note: A production system would need a more robust pattern and validationcusip_pattern = re.compile(r'\b[A-Z0-9]{9}\b')potential_cusips = cusip_pattern.findall(filing_text)if potential_cusips:print(f"Source: {filing_url}")print(f"Found {len(potential_cusips)} potential CUSIPs: {list(set(potential_cusips))}")else:print(f"No potential CUSIPs found in the latest 8-K.")

A production-grade system would require more sophisticated error handling, CUSIP validation logic (including checksum), and the ability to parse various exhibit formats like PDF and XBRL.

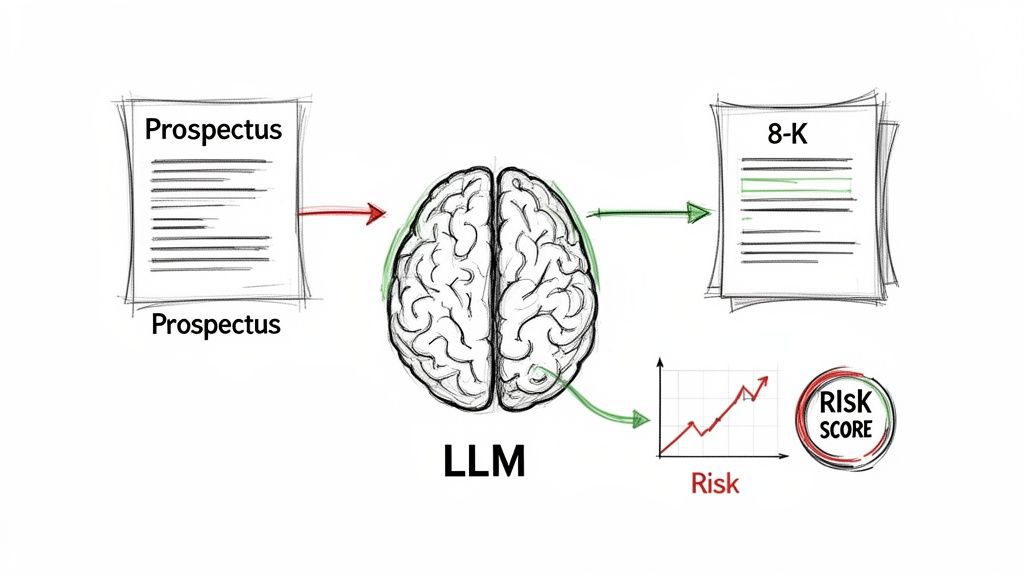

Insights: Implications for Modeling and Explainable AI

Linking deals to 8-K events transforms raw data into structured context, providing fuel for more accurate financial models and explainable AI systems. An event-driven model can project prepayment speeds or default probabilities with greater precision by incorporating real-world triggers. For instance, a model can learn how an 8-K announcing a servicer's financial trouble (Item 2.04) historically correlates with delinquency rates for a specific asset class, such as recent trends in the 2024 CMBS vintage.

This structured context is particularly impactful for Large Language Models (LLMs). An LLM analyzing a prospectus in isolation provides a generic summary. However, when fed the prospectus plus a linked 8-K detailing a recent material agreement, its output becomes far more nuanced. It can reason about the specific implications of that agreement on the deal's future performance. This is the essence of "model-in-context," where every insight is traceable to a source document. We move from black-box predictions toward auditable, context-aware analysis where an LLM can explain why risk has changed by citing specific language in an 8-K filing.

How Dealcharts Helps

Dealcharts connects these datasets—filings, deals, shelves, tranches, and counterparties—so analysts can publish and share verified charts without rebuilding data pipelines. The platform is built on an open context graph that programmatically maps the universe of 8-K event filings to the deals, shelves, tranches, and companies they impact. Instead of engineering complex data ingestion workflows, quants and developers can use the Dealcharts API to pipe this context-rich data directly into models. Every link includes a verifiable data lineage, ensuring that you can trust the connection from source filing to analytical insight.

Conclusion

Successfully linking deals to 8-K filings provides a critical, verifiable layer of context that is indispensable for modern financial analysis. This process enables proactive risk surveillance, enhances due diligence, and provides the explainable data pipelines necessary for advanced modeling and AI. By automating the connection between corporate events and structured finance securities, analysts can move beyond static data to build dynamic, context-aware strategies. Frameworks like CMD+RVL advocate for this approach, creating a foundation for reproducible, explainable finance analytics. You can explore the open context graph at https://dealcharts.org.

Article created using Outrank