Non-Bank Lending Guide

A Guide to Non Bank Lending in Structured Finance

In structured finance, non-bank lending is not merely an alternative; it's a fundamental architectural shift in credit origination and distribution. It represents the ecosystem of private credit funds, fintech platforms, and specialty finance companies operating outside traditional, depository banking regulations. For analysts, quants, and data engineers, understanding this landscape is critical for modeling risk, monitoring asset performance, and building explainable data pipelines. The data is often fragmented across SEC filings and servicer reports, making a clear, verifiable data lineage essential for any credible analysis. Visualizing these complex relationships, such as those found on Dealcharts, is key to navigating this opaque market.

The Market Context for Non-Bank Lending

The rise of non-bank lending is a direct response to post-2008 regulatory frameworks that constrained traditional banks. Non-bank financial institutions now manage nearly half of all global financial assets, filling a crucial gap for borrowers and creating new opportunities for investors. However, this growth introduces significant technical challenges for analysts. Unlike the standardized reporting from bank-sponsored CMBS shelf filings, non-bank data is notoriously fragmented and non-standardized.

Key challenges include:

- Data Fragmentation: Information is scattered across SEC filings (prospectuses, remittance reports), private loan tapes, and servicer portals, requiring complex data integration.

- Opaque Counterparties: Tracing the lineage of originators, servicers, and sponsors is difficult, complicating counterparty risk assessment.

- Non-Standardized Reporting: Loan-level data and performance metrics vary widely in quality and format, demanding robust data normalization and cleaning pipelines before any meaningful analysis can occur.

This environment necessitates a programmatic approach to data ingestion and analysis, where verifiable data lineage isn't a luxury but a core requirement for building trust in any derived insights or models.

The Data and Technical Angle of Non-Bank Lending

For any quant or data engineer, the insights are only as good as the underlying data pipeline. In the world of non-bank lending, this means sourcing, parsing, and linking data from disparate, often unstructured, public filings. The primary source for U.S. public securitizations is the SEC's EDGAR database.

Two filing types are essential for any surveillance or modeling workflow:

- Form 424B5 (Prospectus): This is the deal's blueprint, filed before issuance. It contains the initial collateral statistics, deal structure, and counterparty information (originator, servicer, trustee). It is the foundational document for understanding a deal's intended mechanics.

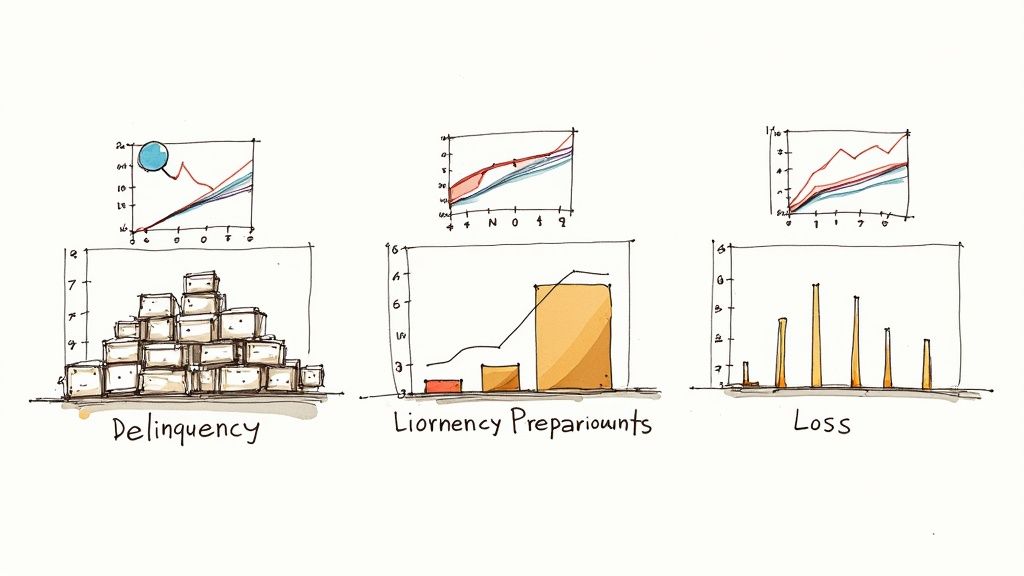

- Form 10-D (Remittance Report): These are the monthly or quarterly performance updates containing critical time-series data on delinquencies, defaults, prepayments, and cash flows. They are the vital signs for tracking a deal's health.

Accessing this data programmatically involves scraping these filings, parsing the HTML or XBRL, and extracting structured information. This is the bottleneck where most manual analysis breaks down. For example, a single delinquency figure from a servicer report is meaningless without its lineage: which SEC filing did it come from? Which SPV does it belong to? How was it calculated? Answering these questions requires a robust data pipeline. Platforms like Dealcharts provide this pre-linked data graph, connecting filings, deals, and counterparties so analysts can query the information directly via APIs or explore datasets like a 2024 CMBS vintage without building the entire ingestion pipeline from scratch.

Example Workflow: Programmatic Data Extraction

A core task for any analyst is linking a deal to its primary counterparties to assess operational risk. This requires parsing filings to extract entity names and roles. The process illustrates the importance of data lineage: moving from a raw source document to a structured, usable insight.

Here’s a conceptual Python snippet demonstrating how to programmatically access EDGAR to begin this process. The goal is to fetch a 10-D filing for a specific deal CIK (Central Index Key) and prepare it for parsing.

from sec_edgar_api import EdgarClient# Initialize the client with your details for the SEC EDGAR APIedgar = EdgarClient(user_agent="Structured Finance Analyst <analyst.email@example.com>")# Source -> Use a deal CIK. This would typically be mapped from a CUSIP or deal name.# Example CIK for a hypothetical Auto Loan ABS Trust.deal_cik = "0001234567"try:# Fetch the latest 10-D filing for the target CIKfilings = edgar.get_filings(cik=deal_cik, form_type="10-D", count=1)if filings:# Transform -> Get the URL of the primary filing documentfiling_url = filings[0]['filing_href']# Insight -> The next step is to download and parse the HTML/XML from this URL.# Libraries like BeautifulSoup or lxml would be used to find tables or text# explicitly identifying the 'Servicer' or other key counterparties.print(f"Data Lineage Step 1: Identified source filing URL.")print(f"Next Step: Download and parse {filing_url} to extract servicer entity.")else:print(f"No 10-D filings found for CIK: {deal_cik}.")except Exception as e:print(f"An error occurred: {e}")

This snippet highlights the first step in an explainable pipeline. The output isn't just a servicer name; it's a servicer name tied directly back to its source filing URL, providing a verifiable data point crucial for risk models and due diligence.

Implications for Modeling and Risk Monitoring

This structured, programmatic approach to non-bank lending data has profound implications. When every data point has a verifiable lineage, it fundamentally improves modeling, risk monitoring, and even the reasoning capabilities of Large Language Models (LLMs). An LLM queried about delinquency trends in a specific ABS deal can ground its answer in specific 10-D reports rather than generating plausible but unverified text.

This is the core idea behind a "model-in-context" framework. Instead of feeding a model disconnected data points, you provide it with a knowledge graph that connects deals, filings, counterparties, and performance metrics. This allows for more sophisticated and defensible analysis, such as:

- Vintage Analysis: Programmatically comparing the performance of a single originator's 2023 vintage against its 2024 vintage.

- Servicer Risk: Aggregating performance metrics across all deals managed by a single servicer to identify systemic operational issues.

- Explainable AI: Building risk models where every input can be traced back to a source document, satisfying regulatory and internal audit requirements.

How Dealcharts Helps

The analytical workflows described—parsing filings, linking counterparties, and tracking performance—are precisely the problems Dealcharts is built to solve. Instead of forcing every analyst and quant to rebuild the same data pipelines, we provide a canonical, connected context graph for structured finance. Dealcharts connects these datasets—filings, deals, shelves, tranches, and counterparties—so analysts can publish and share verified charts, like the tranche details for an auto loan ABS, without rebuilding data pipelines from scratch. This enables teams to focus on generating insights rather than wrestling with data infrastructure.

Conclusion

Analyzing the non-bank lending market requires a shift from manual data hunting to building systematic, explainable data workflows. By treating SEC filings as a primary data source and focusing on programmatic extraction and linkage, analysts can build a verifiable foundation for risk modeling and surveillance. This emphasis on data context and explainability is the future of reproducible finance analytics, creating a more transparent and efficient market for all participants.

A Few Common Questions

What is the primary driver behind the growth in non-bank lending?

The post-2008 regulatory environment, including higher capital requirements for traditional banks, created a vacuum. Non-bank lenders, with more flexible funding models and often more advanced underwriting technology, stepped in to serve borrowers and asset classes that banks found less profitable or too risky. Examples include entities like a Non-Traded Business Development Company, which channels capital to mid-market companies.

How does risk in non-bank assets differ from bank assets?

The risk profile is different due to three main factors: underwriting, funding, and regulation. Non-banks may use proprietary algorithms and alternative data, leading to less standardized collateral pools. Their reliance on market-based funding (warehouse lines, securitization) instead of stable deposits introduces liquidity risk. Finally, lighter regulatory oversight means analysts must conduct deeper due diligence on originator and servicer quality.

Where is the best place to find raw data on non-bank ABS deals?

The foundational source for public deals is the SEC's EDGAR database. The 424B5 prospectus outlines the initial deal structure and collateral characteristics. The ongoing 10-D remittance reports provide monthly or quarterly performance data, including delinquencies, prepayments, and losses. The primary challenge is that this data is unstructured and disconnected, requiring significant programmatic effort to make it usable for analysis. This is the core data infrastructure problem that platforms like https://dealcharts.org are designed to solve.

Article created using Outrank