Student Loan ABS Guide

Unlocking Student Loan Asset Backed Securities with Programmatic Analysis

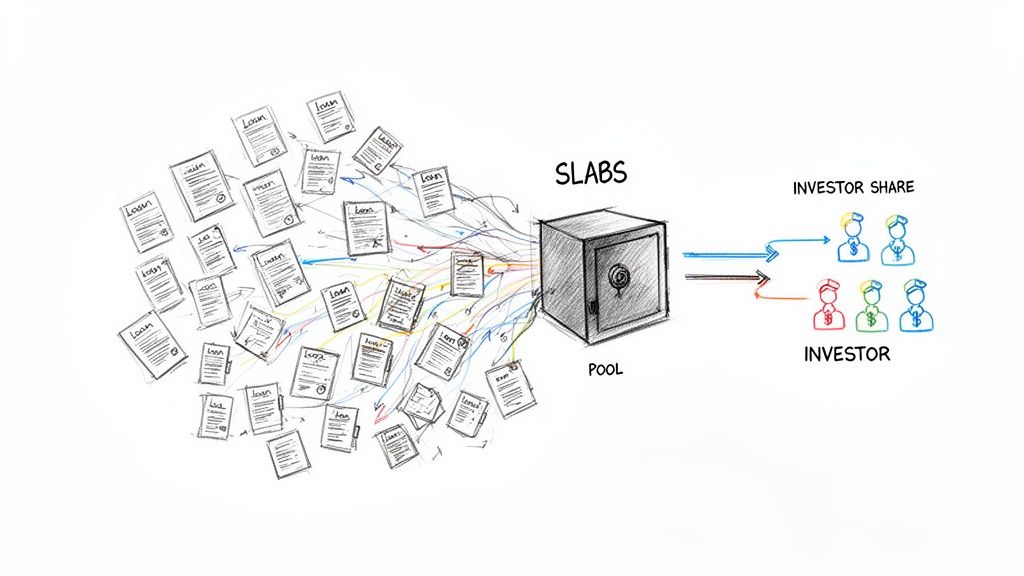

In structured finance, student loan asset backed securities (SLABS) represent a unique asset class where credit performance is inextricably linked to borrower life cycles, economic trends, and public policy. These securities are created by pooling thousands of individual student loans and issuing tranches of debt backed by their future cash flows—a process known as securitization. For analysts, data engineers, and quants, the SLABS market offers a rich dataset for building sophisticated risk models, but only if the underlying data lineage is traceable and verifiable. Programmatic analysis of remittance data from investor reporting is critical for effective deal monitoring and surveillance. Visualizing this interconnected data through platforms like Dealcharts allows for the citation and sharing of verified insights without rebuilding complex data pipelines from scratch.

SLABS Market and Context Overview

SLABS are a significant component of the asset-backed securities market, acting as a key mechanism for lenders to recycle capital and for investors to gain exposure to consumer credit. Their performance serves as a bellwether for the financial health of a highly educated segment of the population, often providing leading indicators for broader consumer credit trends in auto loans or credit cards.

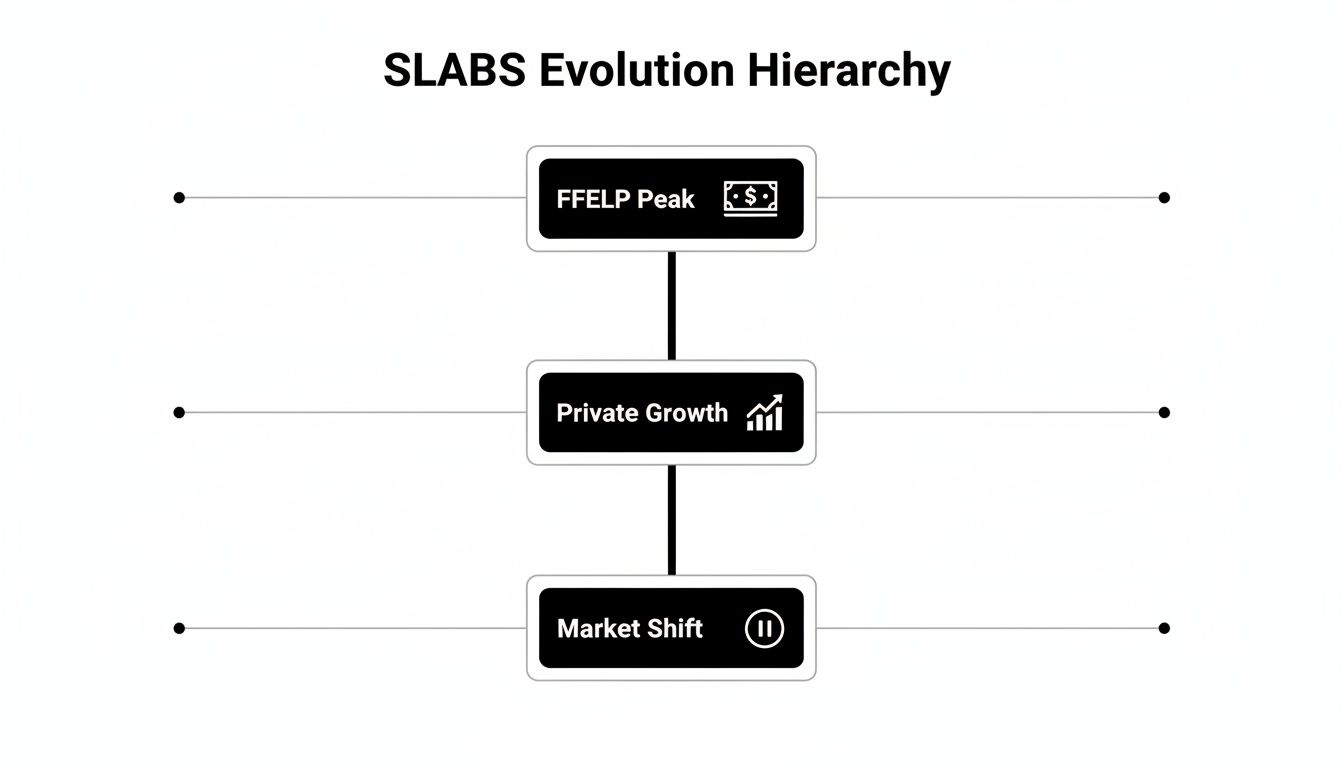

The primary technical challenge in SLABS analysis is the heterogeneity of the underlying collateral. The market is fundamentally divided into two categories, each with a distinct risk profile derived from its data source and structure:

- FFELP SLABS: Backed by loans from the now-defunct Federal Family Education Loan Program, these securities carry an explicit guarantee from the U.S. government, mitigating most of the direct credit risk.

- Private SLABS: Collateralized by private student loans originated by banks and other lenders, these securities carry unmitigated credit risk tied directly to borrower performance.

Any credible analysis begins with this distinction, as modeling assumptions for government-guaranteed versus private credit are fundamentally different. The ongoing trends in the market, such as the impact of federal payment pauses or shifts in refinancing activity, further complicate surveillance and require robust, data-driven approaches. As of Q1 2024, delinquency rates have been gradually increasing, a trend documented in a recent Morningstar DBRS quarterly update.

The Data Sources for Analyzing Student Loan Asset Backed Securities

To programmatically analyze SLABS, one must trace the data from its source. The critical documents and data feeds originate from SEC EDGAR filings and issuer-provided loan-level tapes.

- 424B5 Prospectus: This is the foundational document for any new issuance. It details the deal structure, collateral characteristics, tranche waterfall, and credit enhancement mechanisms. It is the primary source for building a static model of the deal.

- Loan-Level Tapes: These datasets provide granular, anonymized information on each loan in the collateral pool, including FICO scores, loan seasoning, school type, and loan status. Access is often restricted but is essential for deep credit analysis.

- 10-D Filings (Remittance Reports): Filed monthly or quarterly, these reports contain the dynamic performance data for the deal. They detail collections, delinquencies, defaults, prepayments, and the distribution of cash flows to each tranche (CUSIP). These filings are the lifeblood of ongoing surveillance.

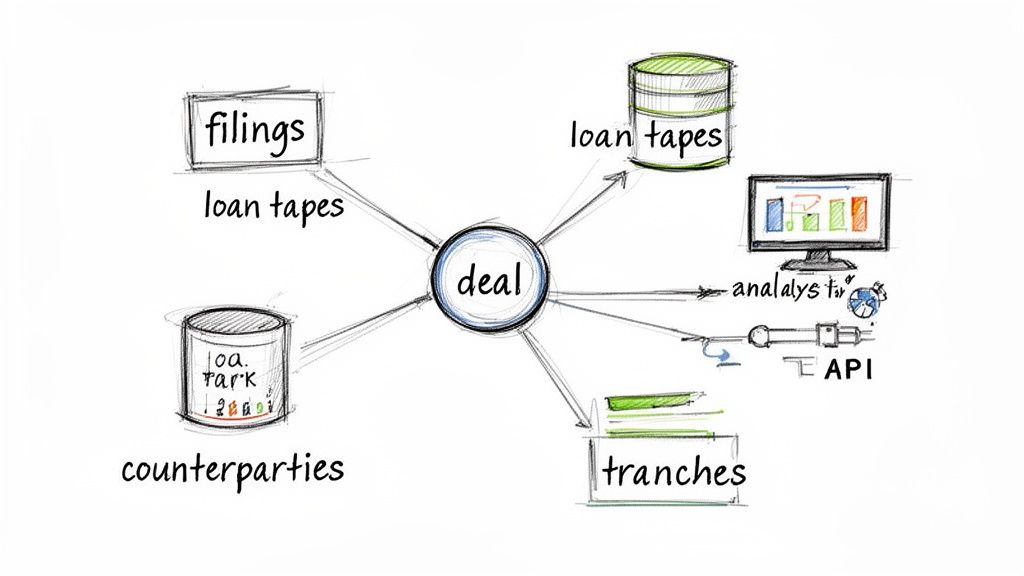

The core technical challenge is linking these disparate sources. An analyst must connect the static deal structure from the 424B5 to the dynamic performance data in the 10-D exhibits. This requires robust parsers capable of extracting structured data from filings and a system for mapping CUSIPs to their corresponding deals and issuers. The Dealcharts dataset and API are designed to solve this problem by providing pre-linked, structured data connecting filings, deals, and counterparties.

Example Workflow: Parsing Remittance Data

A practical workflow involves programmatically extracting performance metrics from 10-D filings to track a deal's health. For instance, an analyst might want to monitor the delinquency rates of a specific SLABS trust. The following Python snippet demonstrates a conceptual approach to fetching and parsing this data.

import requestsimport pandas as pdfrom bs4 import BeautifulSoup# --- Data Lineage ---# Source: SEC EDGAR API (10-D Filings)# Transform: Extract remittance report, parse relevant tables for delinquency data.# Insight: Track 30-59 day delinquency rates over time for a specific trust.# --------------------# Note: This is a simplified example. Real-world parsing requires handling# various formats (HTML, XML, TXT) and more robust error checking.CIK = "0001234567" # Example CIK for a SLABS issuerDEAL_IDENTIFIER = "NAVSL 2023-A" # Example deal namedef get_delinquency_from_10d(cik, deal_id):"""Conceptual function to fetch and parse delinquency data from a 10-D filing."""# 1. Use EDGAR API to find recent 10-D filings for the given CIK# (Implementation for fetching filings list is omitted for brevity)# Assume we have the URL to a specific 10-D exhibit (remittance report)remittance_url = "https://www.sec.gov/Archives/edgar/data/..." # Placeholder URL# 2. Fetch the report contentresponse = requests.get(remittance_url)soup = BeautifulSoup(response.content, 'html.parser')# 3. Find the delinquency table (logic depends heavily on filing format)# This part is highly variable and the most challenging aspect of parsing.# We'll simulate finding the data.delinquency_data = {"30-59 Days Delinquent": 15_234_567.89, # Principal Balance"60-89 Days Delinquent": 8_765_432.10,"Total Pool Balance": 1_250_000_000.00}# 4. Calculate the delinquency raterate_30_59 = (delinquency_data["30-59 Days Delinquent"] / delinquency_data["Total Pool Balance"]) * 100print(f"Deal: {deal_id}")print(f"30-59 Day Delinquency Rate: {rate_30_59:.2f}%")return rate_30_59# --- Execute the workflow ---get_delinquency_from_10d(CIK, DEAL_IDENTIFIER)

This workflow demonstrates clear data lineage: the insight (delinquency rate) is directly derived from a verifiable source (a specific 10-D filing). Reproducibility is key; another analyst running the same code against the same filing should arrive at the identical result.

Implications for Modeling and Risk Monitoring

Structuring SLABS data within a verifiable pipeline has profound implications. It enables "model-in-context" approaches where analytical models are not black boxes but are directly linked to their underlying data sources. When a model flags an increased default risk for a specific tranche, an analyst can immediately trace the signal back to the specific remittance report and collateral performance metrics that triggered it.

This level of explainability is critical for risk monitoring, where understanding the "why" behind a metric's change is as important as the change itself. For AI and LLM applications, this structured context is even more vital. An LLM queried about the risk profile of a deal like Bancorp Bank's 2024 commercial mortgage-backed securities issuance can provide a more accurate and defensible answer if it can access a knowledge graph connecting the deal's CUSIPs to its prospectus, latest 10-D filings, and collateral statistics. This is the foundation of a true context engine for finance. Tracking vintages, such as all ABS and CMBS issuance from 2024, becomes a programmatic query rather than a manual research project.

How Dealcharts Helps

The manual process of linking filings, extracting data, and maintaining surveillance pipelines is inefficient and prone to error. Dealcharts connects these datasets — filings, deals, shelves like the BMARK shelf, tranches, and counterparties — so analysts can publish and share verified charts without rebuilding data pipelines. By providing this data through a structured API, it enables quants and data engineers to build robust, explainable models with a clear and verifiable data lineage, accelerating the path from raw data to actionable insight.

Conclusion

Analyzing student loan asset-backed securities requires a deep understanding of both their unique credit drivers and the technical challenges of sourcing and linking data. By adopting a programmatic approach with a focus on data lineage, analysts can move beyond static reports and build dynamic, explainable surveillance systems. This methodology not only improves risk modeling but also provides the structured context necessary for next-generation financial analytics.