Triple Net Lease

Decoding the Triple Net Lease: A Guide for Structured Finance Analysts

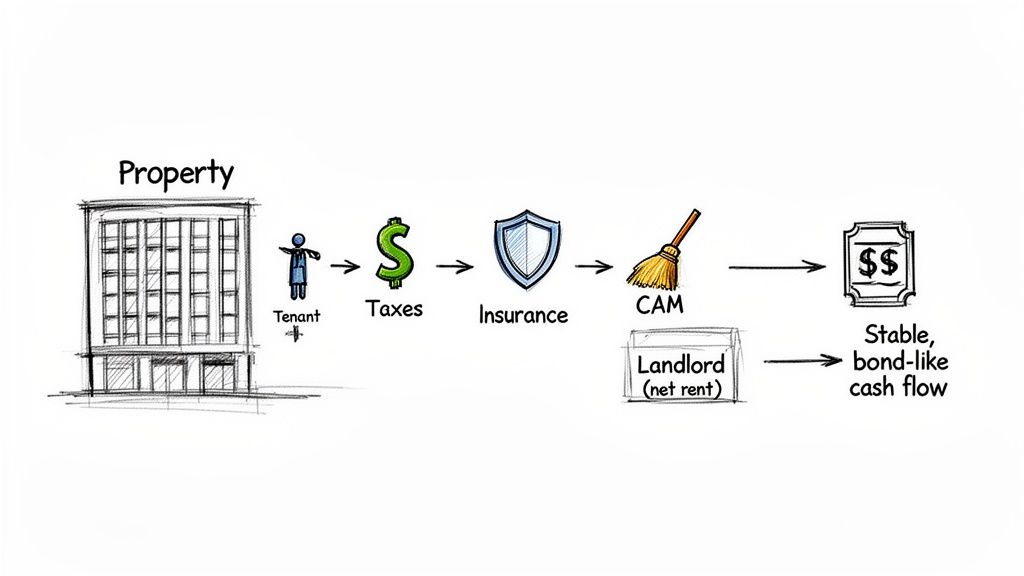

A triple net lease, or NNN lease, is a foundational structure in commercial real estate finance where the tenant agrees to pay not just rent, but also the three "nets": property taxes, building insurance, and common area maintenance (CAM). For structured-finance analysts, understanding this mechanism is critical. It transforms a physical asset into a predictable, almost bond-like cash flow stream, making NNN-leased properties highly attractive collateral for securitization within Commercial Mortgage-Backed Securities (CMBS). This guide breaks down the NNN lease from a data-centric perspective, focusing on its relevance in CMBS, data lineage from public filings, and programmatic analysis. Visualizing the underlying data for these deals is possible with platforms like Dealcharts.

What is a Triple Net Lease in the Context of CMBS Markets?

In the world of CMBS and credit markets, the triple net lease is a mechanism for risk transfer. By shifting variable operating expenses to the tenant, the property owner achieves a highly predictable Net Operating Income (NOI)—the core metric for CMBS underwriting. This stability is why properties with long-term NNN leases to investment-grade tenants are considered premium collateral. The primary risk shifts from operational management to tenant creditworthiness, a factor that is more straightforward to model and underwrite.

This structure is not new; it gained prominence in the post-WWII economic expansion as landlords sought to minimize exposure to fluctuating operating costs. You can find a detailed historical overview in this piece by Realized1031 on the evolution of NNN leases.

For analysts, the key takeaways are:

- Predictable Cash Flow: NOI is insulated from operational volatility, simplifying cash flow projections.

- Reduced Management Burden: The passive nature of the investment simplifies the ownership model.

- Credit-Linked Risk: Analysis focuses on tenant default probability, a credit-centric problem rather than a real estate operational one.

Current market trends, such as shifts in the retail and office sectors, place even greater emphasis on the quality of the tenant and the structure of the lease. A downturn in a specific industry can quickly impact the performance of CMBS pools with high concentrations of NNN-leased properties in that sector, such as those in the CMBS 2019 vintage. The technical challenge for analysts is to programmatically identify, verify, and monitor these lease structures across vast portfolios using verifiable data from source filings.

Comparing NNN Leases to Other Commercial Lease Structures

To fully grasp the NNN lease's role, it's useful to compare it against other common commercial lease structures. Each type allocates responsibilities differently, directly impacting risk and cash flow predictability for CMBS collateral.

| Lease Type | Tenant Responsibility | Landlord Responsibility | Typical CMBS Collateral Profile |

|---|---|---|---|

| Gross Lease | Pays a single, all-inclusive flat rent. | Covers all operating expenses (taxes, insurance, maintenance). | Common in multi-tenant office buildings; NOI is less predictable. |

| Single Net (N) | Pays base rent + property taxes. | Covers insurance, maintenance, and all other expenses. | Less common; offers minimal expense pass-through for the landlord. |

| Double Net (NN) | Pays base rent + property taxes + insurance. | Covers maintenance (especially structural repairs) and capital expenditures. | Often seen in industrial and some retail properties. |

| Triple Net (NNN) | Pays base rent + taxes + insurance + maintenance (CAM). | Typically limited to major structural repairs (roof, foundation), if that. | The gold standard for stable, single-tenant retail, QSR, and healthcare. |

| Absolute NNN | Pays all expenses, including structural and roof repairs. No landlord costs. | Zero property-related financial responsibilities. | Highly sought-after; considered the most passive real estate investment. |

The NNN lease sits at the far end of the risk-transfer spectrum, making it a powerful tool in securitized real estate debt by isolating tenant credit risk. You can find a solid overview of this structure over at VAC Development's site.

The Data and Technical Angle: Sourcing NNN Lease Data

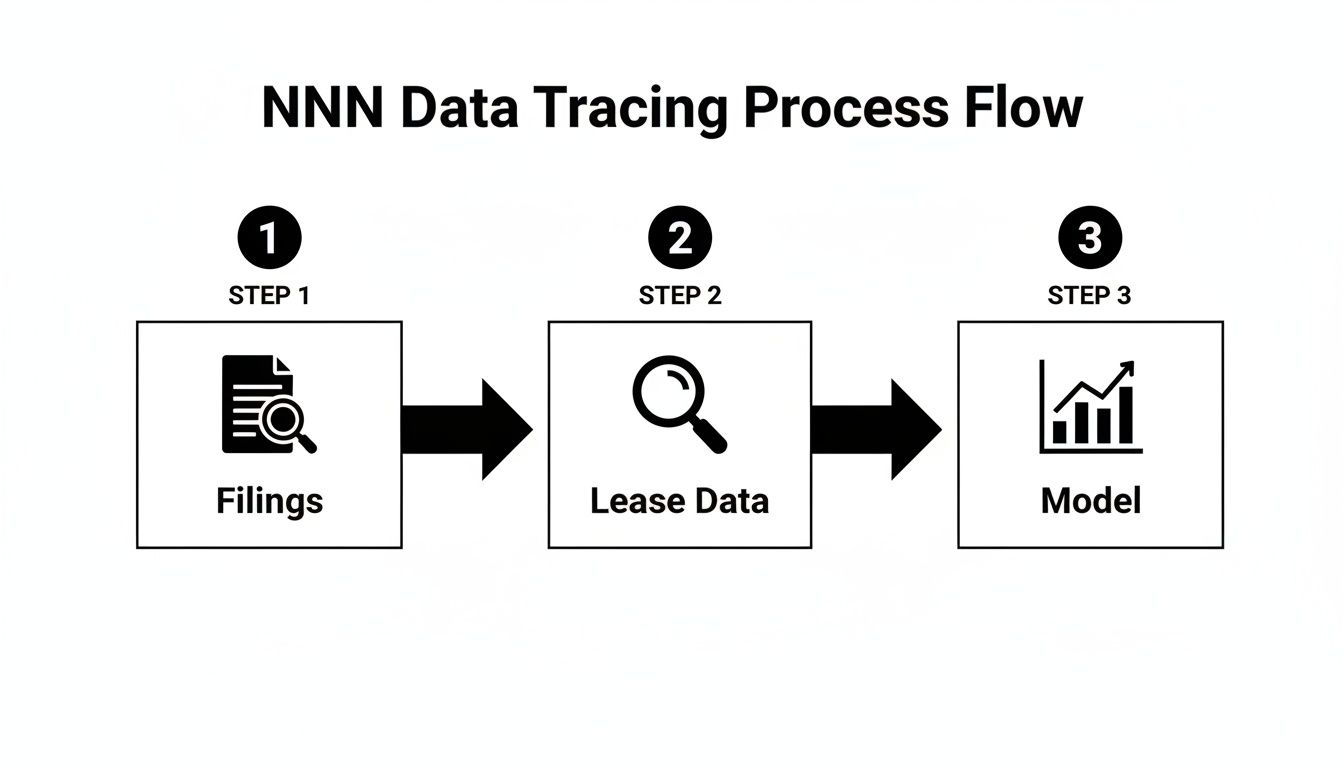

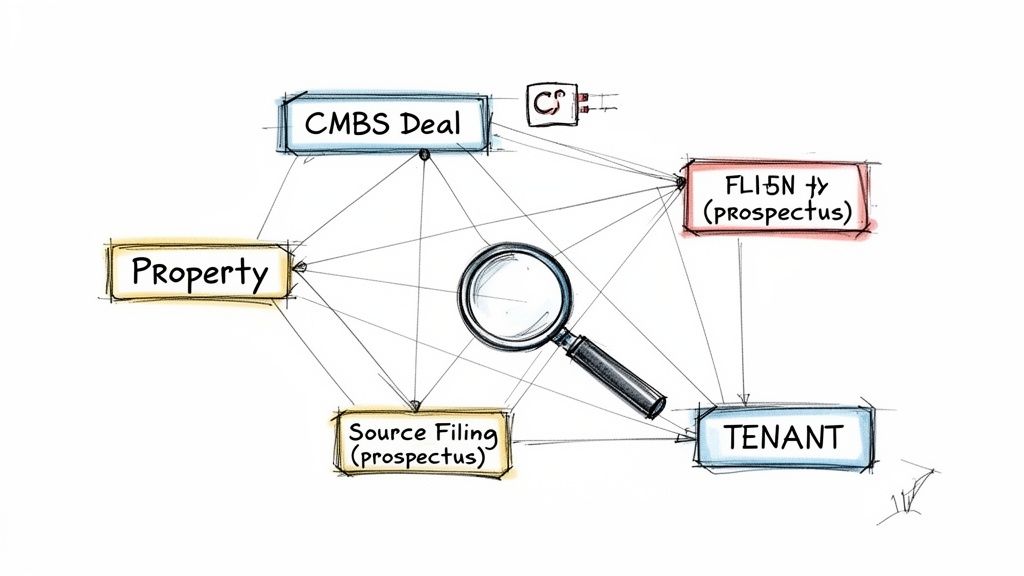

For a quantitative analyst or data engineer, a claim is only as good as its verifiable source. The assertion that a property is governed by a triple net lease must be traced back to its data lineage within public securities filings. This process begins with offering documents and continues through ongoing servicer reports.

The primary data sources for NNN lease verification include:

- 424B5 Prospectuses: These SEC filings, issued at the time of a CMBS deal's offering, contain the initial rent rolls, property-level financials, and lease abstracts. Analysts must parse these documents to find explicit reimbursement clauses.

- CREFC Investor Reporting Packages (IRP): These are monthly reports produced by the loan servicer that provide updated rent rolls and operating statements. They are crucial for monitoring the ongoing performance and verifying that tenants continue to cover expenses as stipulated.

To programmatically identify a true NNN lease, an analyst must look for specific data fields within these documents, such as rent roll tables that break down reimbursement percentages. The key is to find columns that explicitly state:

- Tax Reimbursement %: Must be 100%.

- Insurance Reimbursement %: Must be 100%.

- CAM Reimbursement %: Must be 100%.

Any deviation from 100% in these fields indicates a modified gross or double net (NN) lease, which carries a different risk profile. The term "NNN" is often used loosely in marketing materials; only the data in the filings provides the ground truth. For instance, analyzing the source documents for a deal like the CSAIL 2019-C16 Commercial Mortgage Trust allows an analyst to trace property performance from inception.

Example Workflow: Programmatic NNN Lease Identification

Manual review of lease data across a large CMBS portfolio is inefficient and prone to error. A programmatic workflow enables scalable, reproducible analysis. The goal is to create a data pipeline that transforms raw, unstructured data from filings into a structured dataset ready for risk modeling.

This process demonstrates clear data lineage: Source (SEC Filing) → Transform (Parse & Filter) → Insight (Risk Metric)

Below is a simplified Python snippet demonstrating how to parse a simulated rent roll DataFrame to identify NNN properties and calculate their Weighted Average Lease Term (WALT).

import pandas as pdimport numpy as np# Sample DataFrame simulating a rent roll from a CMBS data tapedata = {'property_id': ['P1', 'P2', 'P3', 'P4', 'P5'],'tenant_name': ['PharmaCorp', 'Logistics Inc', 'Retail LLC', 'Office Co', 'MedCare'],'lease_sqft': [15000, 250000, 5000, 20000, 12000],'lease_expiration': ['2035-12-31', '2032-06-30', '2028-01-31', '2030-05-31', '2038-08-31'],'tax_reimbursement_%': [100, 100, 100, 50, 100],'insurance_reimbursement_%': [100, 100, 100, 100, 100],'cam_reimbursement_%': [100, 100, 0, 100, 100],}rent_roll_df = pd.DataFrame(data)rent_roll_df['lease_expiration'] = pd.to_datetime(rent_roll_df['lease_expiration'])# --- Data Transformation: Identify True NNN Leases ---# The filter requires the tenant to cover 100% of all three expense categories.nnn_filter = (rent_roll_df['tax_reimbursement_%'] == 100) & \(rent_roll_df['insurance_reimbursement_%'] == 100) & \(rent_roll_df['cam_reimbursement_%'] == 100)nnn_properties = rent_roll_df[nnn_filter].copy()# --- Insight Generation: Calculate WALT for the NNN Portfolio ---# Calculate the remaining lease term in yearscurrent_date = pd.to_datetime('today')nnn_properties['remaining_term_years'] = (nnn_properties['lease_expiration'] - current_date).dt.days / 365.25# Calculate WALT, weighted by square footagetotal_sqft = nnn_properties['lease_sqft'].sum()nnn_properties['weight'] = nnn_properties['lease_sqft'] / total_sqftwalt = np.average(nnn_properties['remaining_term_years'], weights=nnn_properties['weight'])print(f"Identified {len(nnn_properties)} true NNN properties based on reimbursement data.")print(f"Weighted Average Lease Term (WALT) for the NNN portfolio: {walt:.2f} years")

This script precisely identifies true NNN leases by filtering on reimbursement percentages, excluding properties like P3 (NN lease) and P4 (modified lease). This automated approach can be scaled across entire CMBS shelves, such as the COMM mortgage trust program, providing consistent and defensible risk metrics.

Insights and Implications for Modeling

Structuring NNN lease data this way has significant implications for risk modeling, surveillance, and even Large Language Model (LLM) reasoning. A clear data pipeline that connects insights back to source documents enables a "model-in-context" approach.

When modeling risk for a triple net lease property, the primary factor is tenant default. The analysis shifts from real estate operational forecasting to corporate credit analysis. Key modeling considerations include:

- Tenant Concentration Risk: High exposure to a single tenant or industry creates correlated risk.

- Lease Rollover Risk: A portfolio with near-term lease expirations faces vacancy and re-leasing costs.

- Market Risk: Sector-specific headwinds, like the recent downturn in office space demand, directly impact tenant viability. You can read more about market dynamics in the NNN office space.

Furthermore, explainable data pipelines are critical for advanced applications like training LLMs. By feeding an LLM structured data with clear lineage (e.g., lease clauses linked to specific filings), the model can reason about complex legal language and identify non-standard clauses—such as unusual co-tenancy provisions or capital expenditure loopholes—that a purely quantitative model would miss. This fusion of structured data and unstructured text analysis is central to building next-generation context engines for financial analysis.

How Dealcharts Helps

The programmatic workflow described requires significant data engineering to build and maintain pipelines that source, parse, and link data from disparate public filings. This is the exact problem Dealcharts solves.

Dealcharts connects these datasets—filings, deals, shelves, tranches, properties, and counterparties—so analysts can publish and share verified charts without rebuilding data pipelines. The platform provides a pre-built, navigable graph of structured finance data, where every data point is linked back to its source document. This allows analysts to instantly query for NNN lease concentrations, WALT calculations, or tenant exposures across the entire CMBS market, transforming hours of data work into seconds of analysis.

Conclusion

Understanding the triple net lease is fundamental for any analyst in commercial real estate or structured finance. However, modern analysis demands more than just a conceptual grasp; it requires the ability to programmatically verify lease structures using data with clear, traceable lineage from source filings. This data-centric approach ensures that risk models are accurate, defensible, and built on a foundation of verifiable truth. Frameworks like CMD+RVL advocate for this type of explainable, reproducible finance analytics, where every insight can be traced back to its origin.

At Dealcharts, we connect these disparate datasets—linking filings, deals, properties, and tenants—so analysts can publish and share verified charts with embedded citations, eliminating the need to rebuild data pipelines from scratch. Explore our connected data graph at https://dealcharts.org.

Article created using Outrank