Prepayment Risk Guide

A Guide to Prepayment Risk in MBS & ABS

Prepayment risk is the core uncertainty facing investors in structured finance products like Mortgage-Backed Securities (MBS) and Asset-Backed Securities (ABS). It's the risk that borrowers will repay their loans earlier than scheduled, disrupting the anticipated cash flows that valuation and risk models are built upon. When a loan is paid off early, an investor receives their principal back sooner than expected. While this might seem beneficial, it often forces reinvestment at lower prevailing interest rates, reducing the total return. For structured-finance analysts, data engineers, and quants, understanding and modeling this risk is not an academic exercise; it's a critical component of portfolio management and surveillance. Visualizing historical prepayment data on platforms like Dealcharts can help ground these models in verifiable data from source filings.

Market Context: Why Prepayment Risk Matters in CMBS/ABS

For any structured-finance analyst, what is prepayment risk is a live variable that can compress or extend a bond’s duration, directly impacting returns. When a homeowner refinances a mortgage or a business sells a commercial property, the underlying loan backing a security is extinguished. This event returns principal to investors early but terminates the future stream of interest payments priced into the security's valuation.

This dynamic became a significant challenge for the MBS market in the early 2000s. As the Federal Reserve aggressively cut interest rates between 2001 and 2003, a wave of mortgage refinancing caused prepayment speeds to skyrocket. Investors holding premium-priced MBS saw the effective duration of their portfolios collapse from a projected 5-7 years to as little as 2-3 years, triggering significant capital losses. You can read more about how these market dynamics impacted MBS investments during that period. This historical context underscores the necessity of robust prepayment models built on verifiable data.

This phenomenon creates two primary risks:

- Contraction Risk: Occurs when interest rates fall. Prepayments accelerate as borrowers refinance, returning principal to investors faster than anticipated. This forces reinvestment at lower yields, reducing overall returns.

- Extension Risk: Occurs when interest rates rise. Prepayments slow as the incentive to refinance disappears. This locks investor capital into lower-yielding assets for longer than planned.

Taming this uncertainty requires a data-first approach, moving beyond definitions to quantify the drivers and model outcomes based on verifiable data lineage.

The Data Source: Tracing Risk to EDGAR Filings

The ground truth for prepayment analysis originates in monthly servicer reports, which for public securitizations are filed with the SEC as exhibits to Form 10-D. These remittance reports contain the raw collateral performance data—beginning and ending principal balances, scheduled payments, and unscheduled principal collections—needed to calculate historical prepayment speeds.

However, this data is often unstructured, embedded within HTML, TXT, or XBRL formats in EDGAR filings, making programmatic access and parsing a significant technical hurdle. Analysts and developers must build data pipelines to:

- Identify and retrieve the correct 10-D filing from EDGAR for a specific deal and reporting period.

- Parse the filing to locate and extract data from the relevant collateral performance tables.

- Link the pool-level data to specific securities (e.g., by CUSIP) to analyze individual tranches.

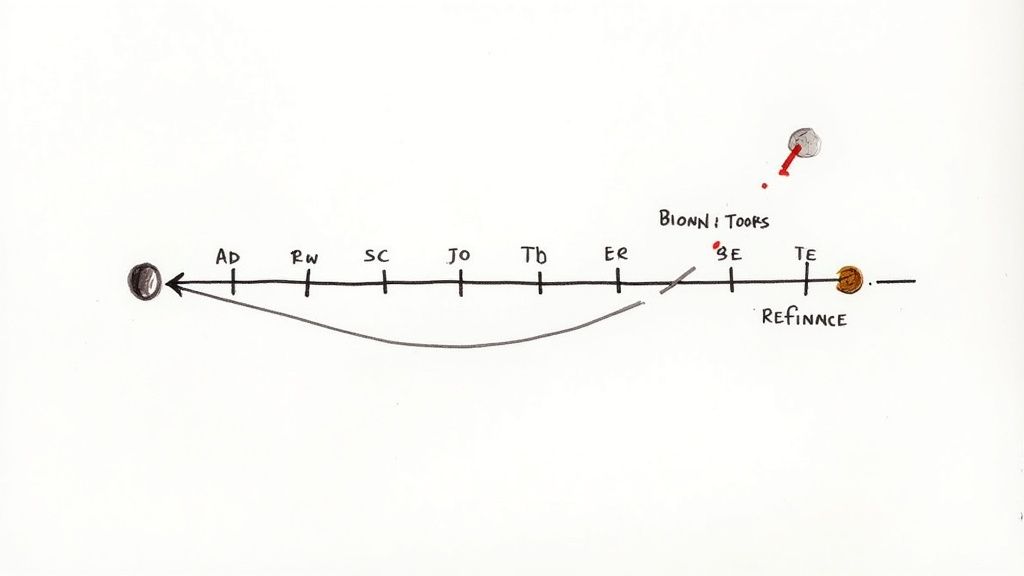

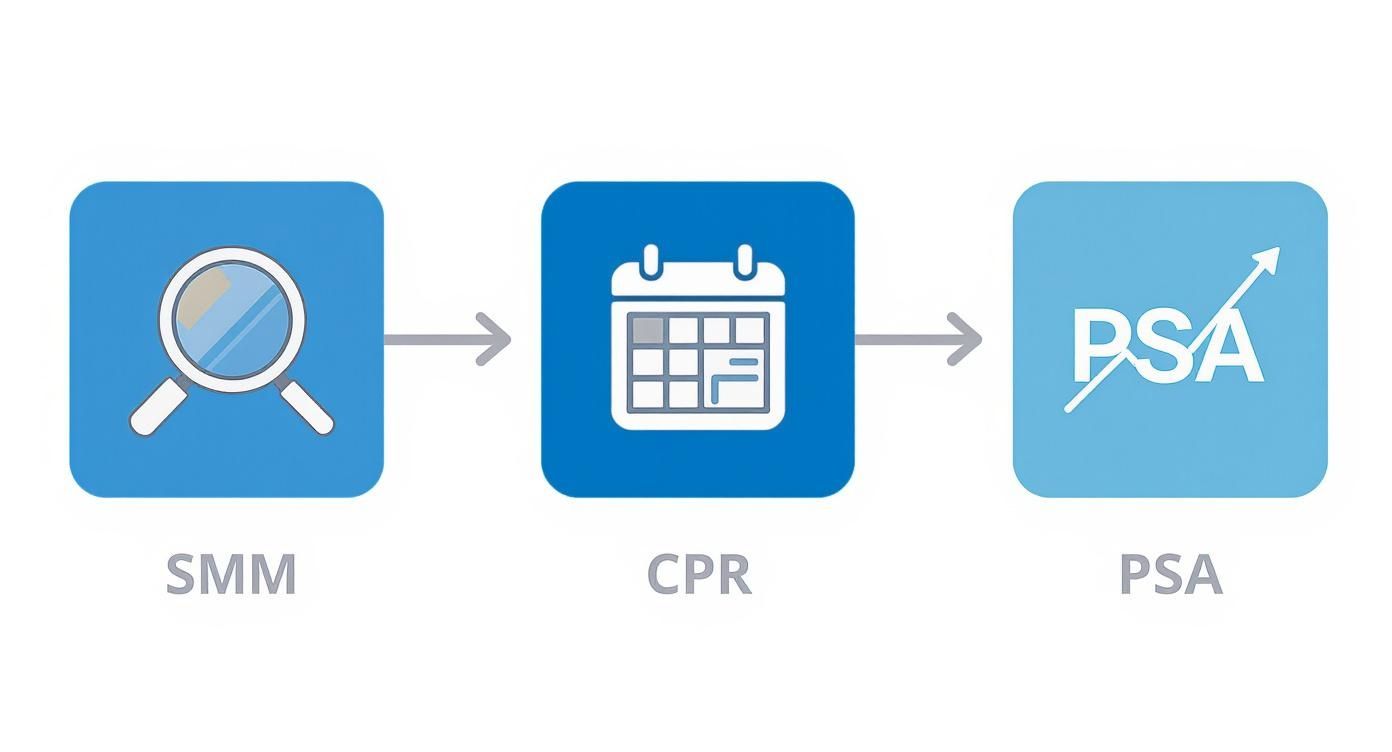

- Calculate metrics like Single Monthly Mortality (SMM) and Conditional Prepayment Rate (CPR) from the extracted principal balance figures.

This "source → transform → insight" workflow is fundamental to building explainable models. Without a clear data lineage back to the source filing, any prepayment analysis lacks verifiability. Platforms like Dealcharts automate this pipeline, providing structured datasets derived directly from these filings, allowing analysts to focus on modeling rather than data engineering. For example, prepayment data for deals like the recent auto ABS from Exeter Automobile Receivables Trust (EART 2024-1) can be traced directly to its underlying 10-D filings.

Example Workflow: Calculating SMM from Servicer Data

A programmatic approach is essential for reproducible prepayment analysis. The following Python snippet illustrates the foundational logic for fetching a 10-D filing and calculating the Single Monthly Mortality (SMM), the most granular measure of prepayment speed.

This example highlights the core challenge: reliably extracting numerical data from unstructured text. While the SMM formula is simple, the engineering effort lies in building a robust parser that can handle the format variations across different issuers and filings.

import requestsfrom bs4 import BeautifulSoup# This is a conceptual example; a real workflow requires a CIK and specific accession number.# filing_url = "https://www.sec.gov/Archives/edgar/data/{CIK}/{ACCESSION_NUMBER}/..."# response = requests.get(filing_url)# soup = BeautifulSoup(response.content, 'html.parser')# --- Step 1: Data Extraction (Conceptual) ---# The core challenge is finding the correct table and values within the HTML.# This requires sophisticated parsing logic tailored to specific filing formats.# Let's assume we've successfully parsed these values from a remittance report table.scheduled_principal = 500_000_000 # Beginning balance for the periodending_principal = 497_000_000 # Actual ending balancescheduled_payment = 1_000_000 # Scheduled principal payment for the period# --- Step 2: SMM Calculation (The Insight) ---# This shows the data lineage: Source (filing values) -> Transform (calculation) -> Insight (SMM)prepayment_amount = scheduled_principal - ending_principal - scheduled_paymentsmm_calculation_base = scheduled_principal - scheduled_paymentsmm = prepayment_amount / smm_calculation_baseprint(f"--- Data Lineage Example ---")print(f"Source Scheduled Principal: ${scheduled_principal:,.0f}")print(f"Source Ending Principal: ${ending_principal:,.0f}")print(f"Derived Prepayment Amount: ${prepayment_amount:,.0f}")print(f"Calculated SMM: {smm:.4%}")# SMM is then annualized to get the Conditional Prepayment Rate (CPR):# CPR = 1 - (1 - SMM)**12

This workflow—from a source filing to a derived metric—demonstrates the principle of explainability. Every number in a robust model must be traceable to its origin, ensuring the entire analysis is defensible and reproducible.

Implications for Risk Modeling and LLMs

Structuring prepayment data with clear lineage has profound implications. For traditional risk modeling, it provides verifiable inputs, allowing analysts to build more accurate and defensible cash flow models for securities like the WF-C59 Mortgage Trust (WFCM 2021-C59). It enables the creation of historical prepayment curves for specific shelves, issuers, or collateral types, moving beyond generic benchmarks like the PSA model.

This structured, context-rich data also enhances the reasoning capabilities of Large Language Models (LLMs). An LLM with access to a knowledge graph connecting deals, filings, and calculated metrics can answer complex queries like, “Compare the CPR volatility of CMBS vintages from 2020 to pre-crisis vintages during periods of falling interest rates.” This is the essence of the “model-in-context” approach championed by CMD+RVL: embedding analytical models within a rich, verifiable data ecosystem to produce explainable outputs. An explainable pipeline ensures that every output, whether from a quantitative model or an LLM, can be traced back to its source documents, satisfying regulatory and due diligence requirements.

How Dealcharts Helps

Dealcharts connects these disparate datasets—filings, deals, shelves, tranches, and counterparties—so analysts can publish and share verified charts without rebuilding data pipelines. By providing programmatic access to structured, source-linked data, the platform eliminates the undifferentiated heavy lifting of data extraction and cleaning. This allows quantitative analysts and data scientists to focus on higher-value tasks like model development, scenario analysis, and generating insights, all while maintaining a completely verifiable data lineage.

Conclusion

Effectively managing prepayment risk requires moving beyond theoretical definitions to a quantitative, data-driven workflow. The ability to programmatically access, parse, and analyze data from source filings is paramount. By building models on a foundation of verifiable data lineage, analysts can create transparent, reproducible, and defensible insights. Frameworks like CMD+RVL and platforms built upon them provide the necessary "context engine" to power this next generation of explainable financial analytics, transforming raw data into trusted intelligence.

Article created using Outrank